Day seven.

QUESTION 4: – “Can previous Chinese recessive syndrome (Shanghai Composite Index) make worse the global crisis? If it happens again, could this hurt the S&P500, Nasdaq, DJIA and Dow indexes? At last, how strong fixed the intermarket relationship?”

ANSWER 4: – “Of course, the Asian crisis has strong influence, because all markets are interconnected! First, the situation with a strong dollar is very inflated and does not correspond to the actual economic situation in the United

State, which makes US products uncompetitive by the cost of manufactured goods with analogues manufacturers in the world! Secondly, intermarket factors are interrelated. For example, in Asia (1997-1998), as a result of the currency crisis, there was a deflation, which covered the whole world, certainly has moved beyond and struck the bond and stock markets, including the United States! Furthermore, be extremely careful with the S&P500, because if the Chinese

index rates rapidly fallen down, we shoud expect the falling down not only American indexes, but whole the world financial systems.

QUESTION 5: – “What negative factors impeding to successful trading you can define?”

ANSWER 5: – “There are a lack of perseverance and mental integrity, the inability to be flexible, too obvious Ego (the appearance of positive results), impatience, anxiety due to a lack of practical experience, the boredom and the most important exposure to the somebody’s points of view”.

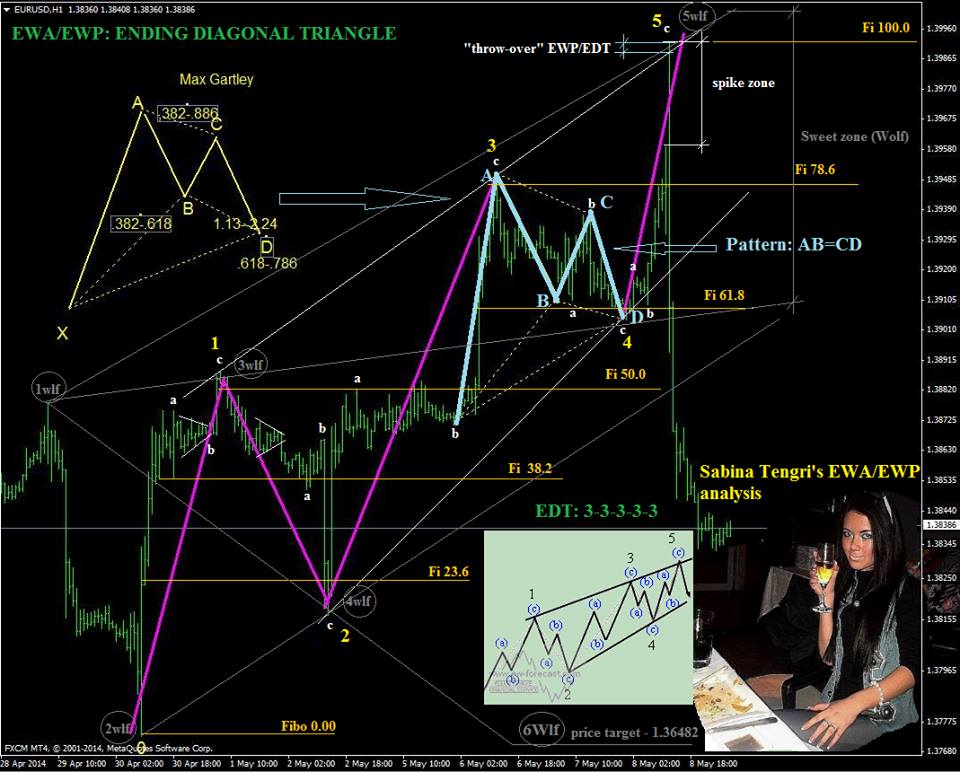

QUESTION 6: – “What is the main point in the study of R.N. Elliott Wave Theory? For what should be pay the main attention?”

ANSWER 6: – “Of course, there are unshakeable rules of EWA/EWP, and then it is enough to know the basic principles of the market, such as: any market is made up by people, and people are never changed during the short period of time (100-500 years). They should regularly make the same mistakes, have the similar reaction to the standard situation on the markets”.

Kind regards, Team traders “Powerful Traders”