ALGORITHMIC SYSTEM

“INTERMARKET ANALYSIS & TIME SESSIONS” (I PART)

First Section: ( 4 webinars )

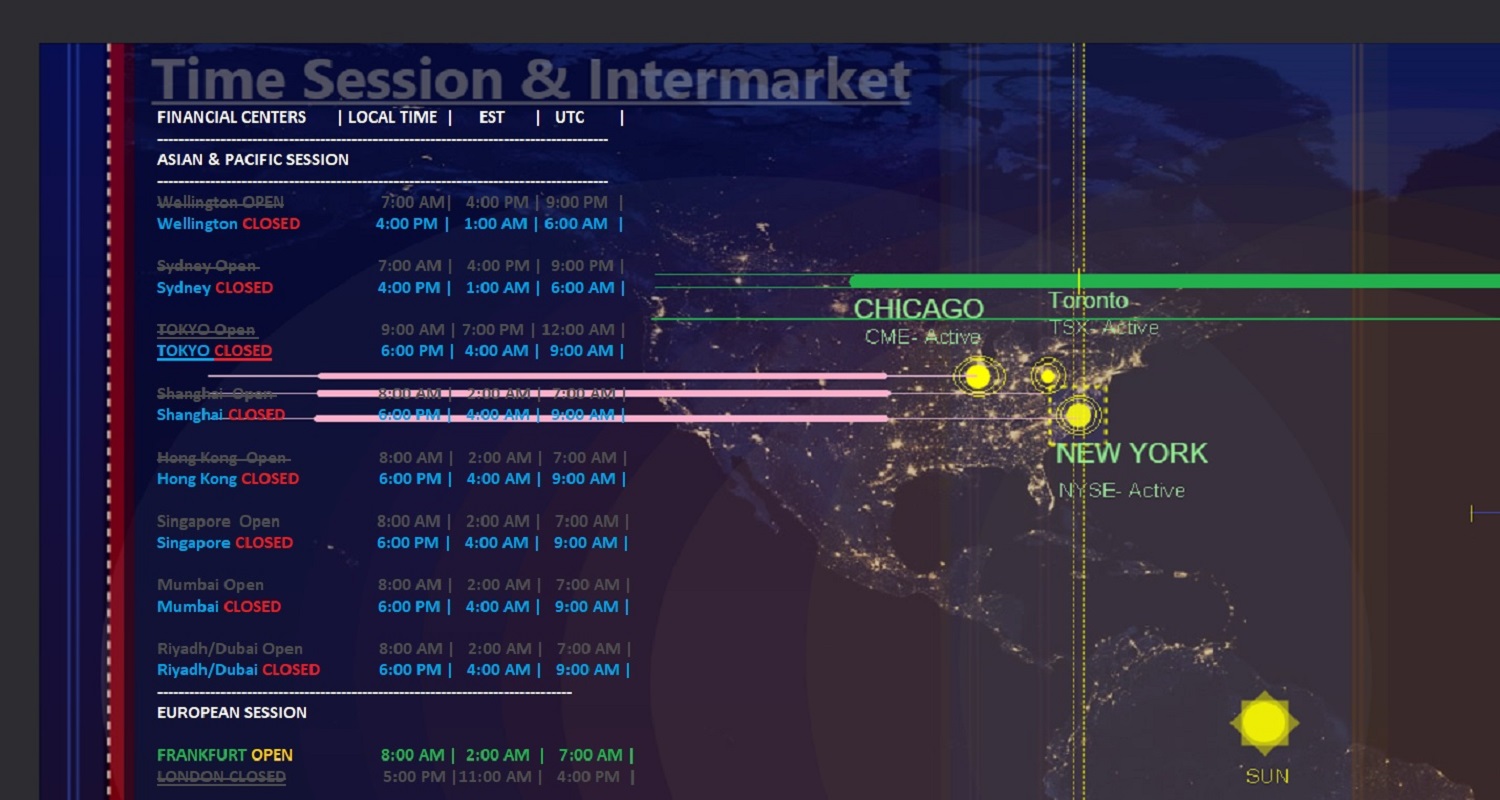

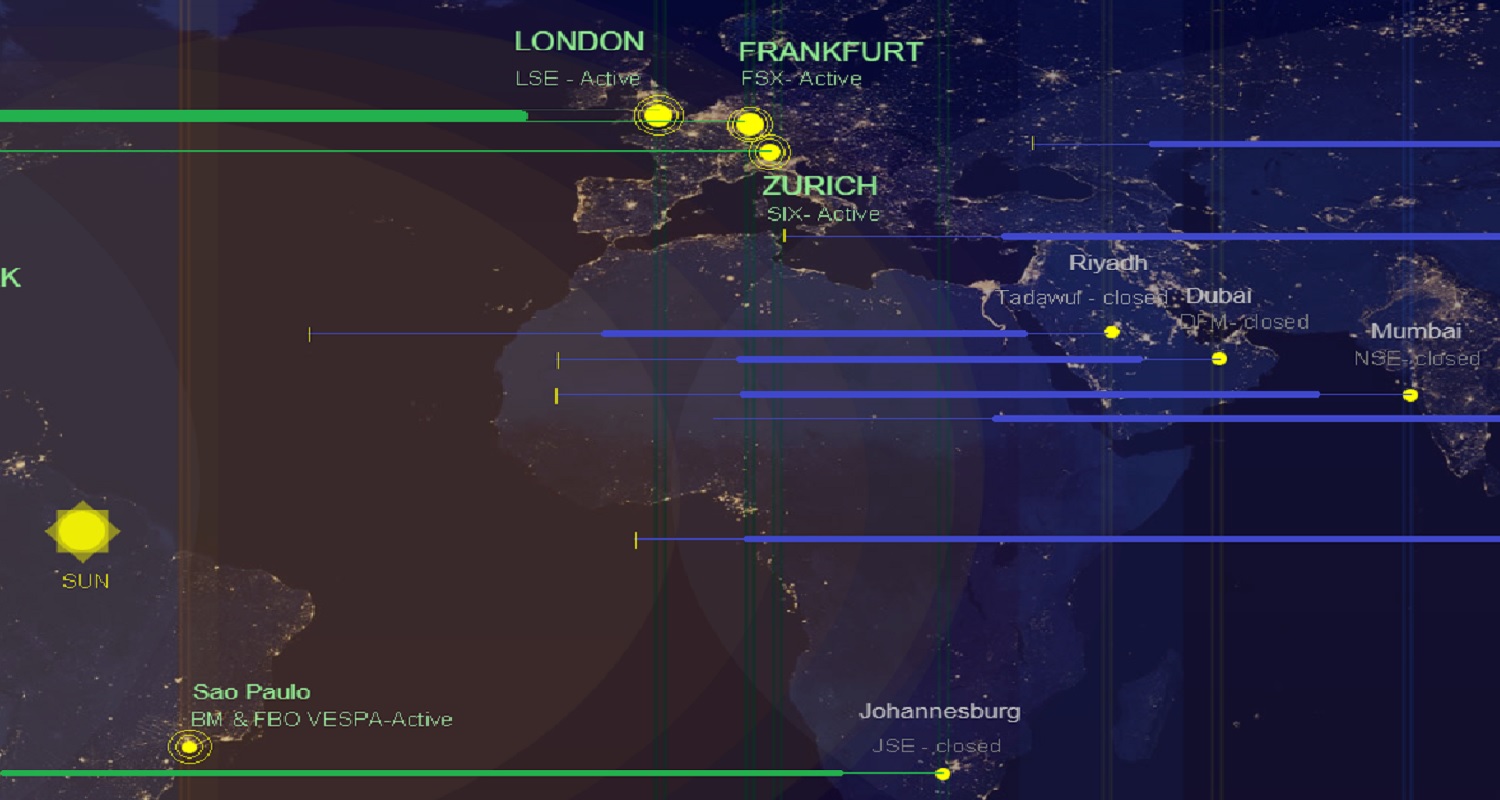

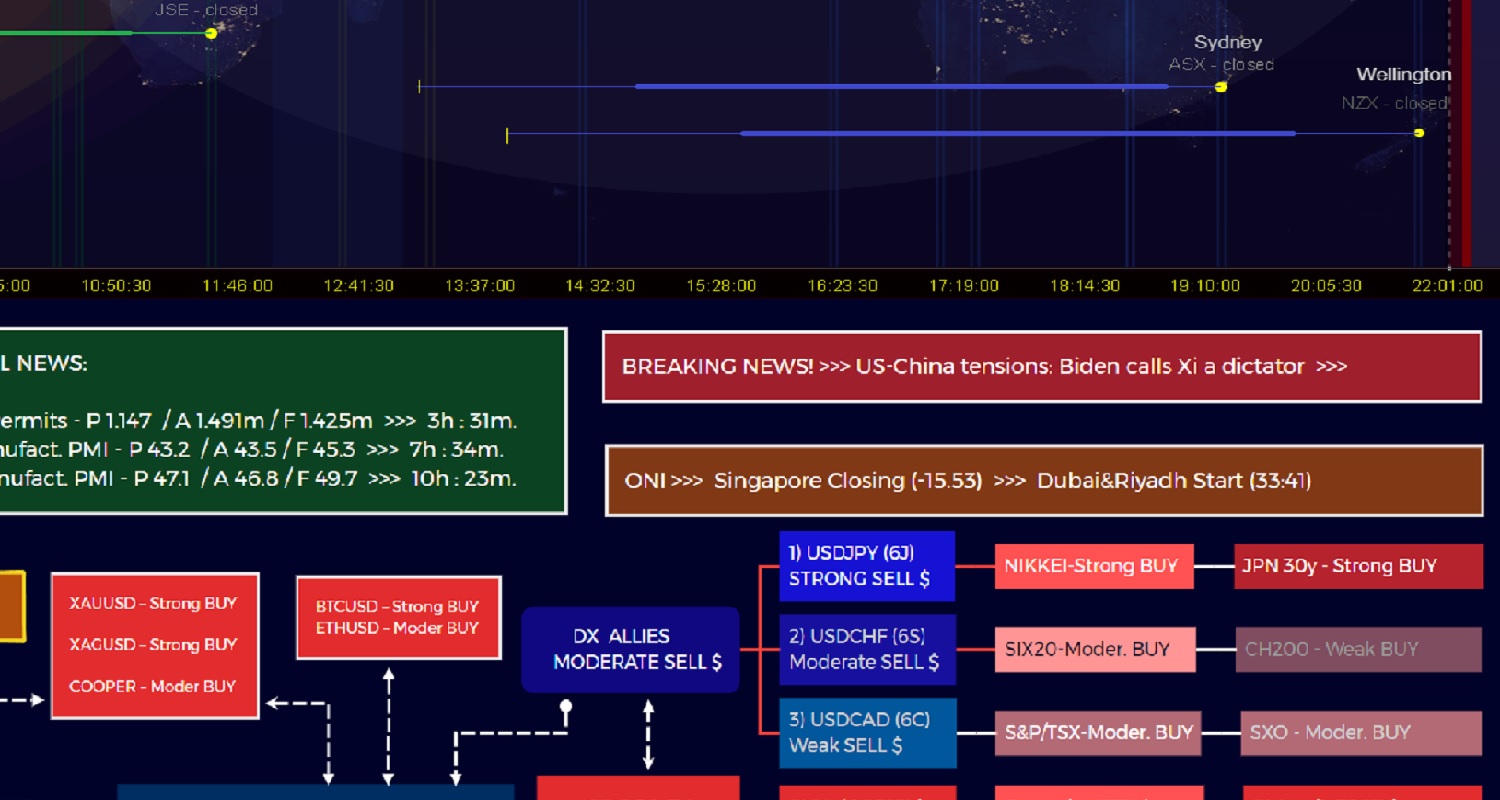

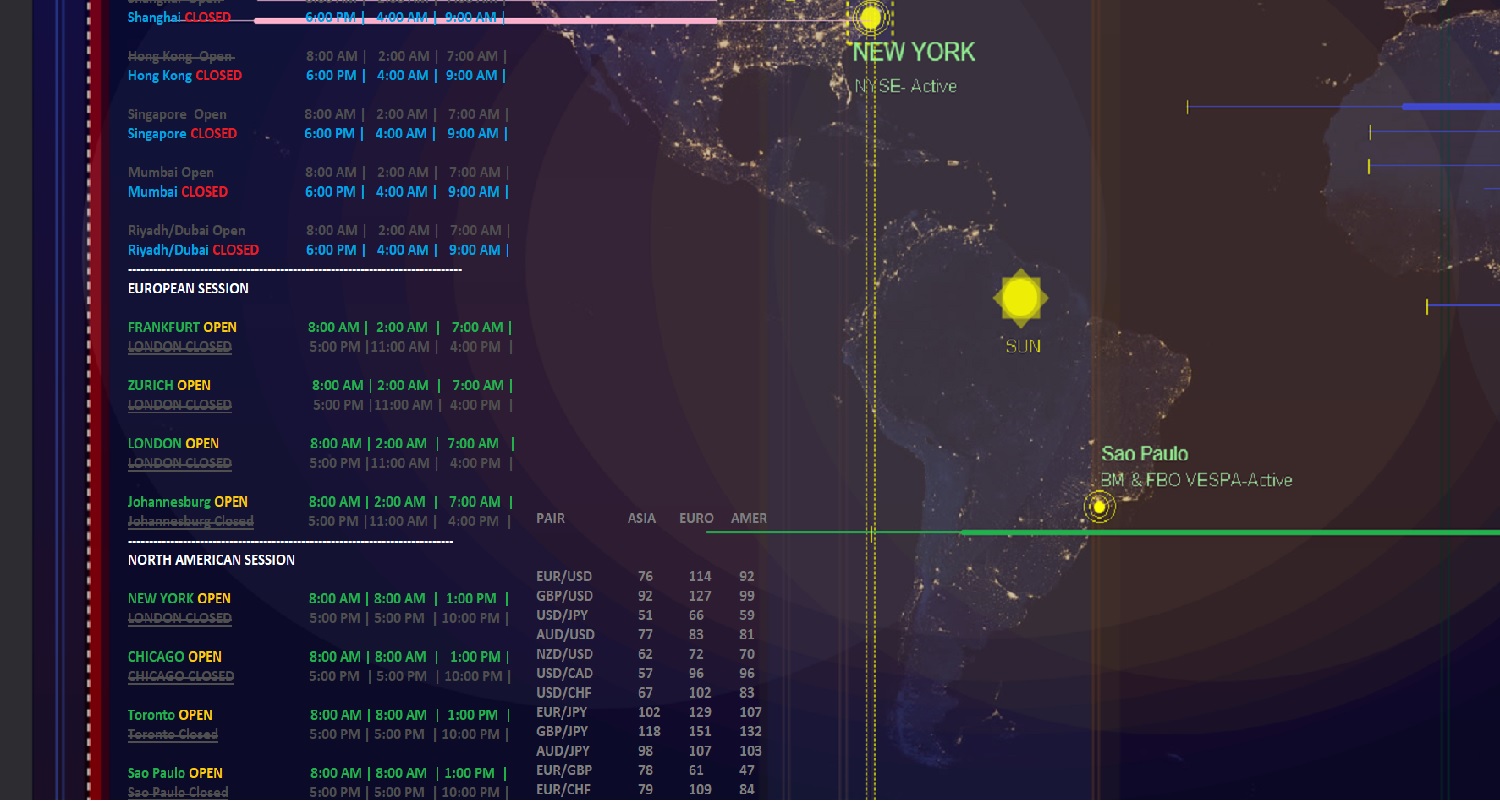

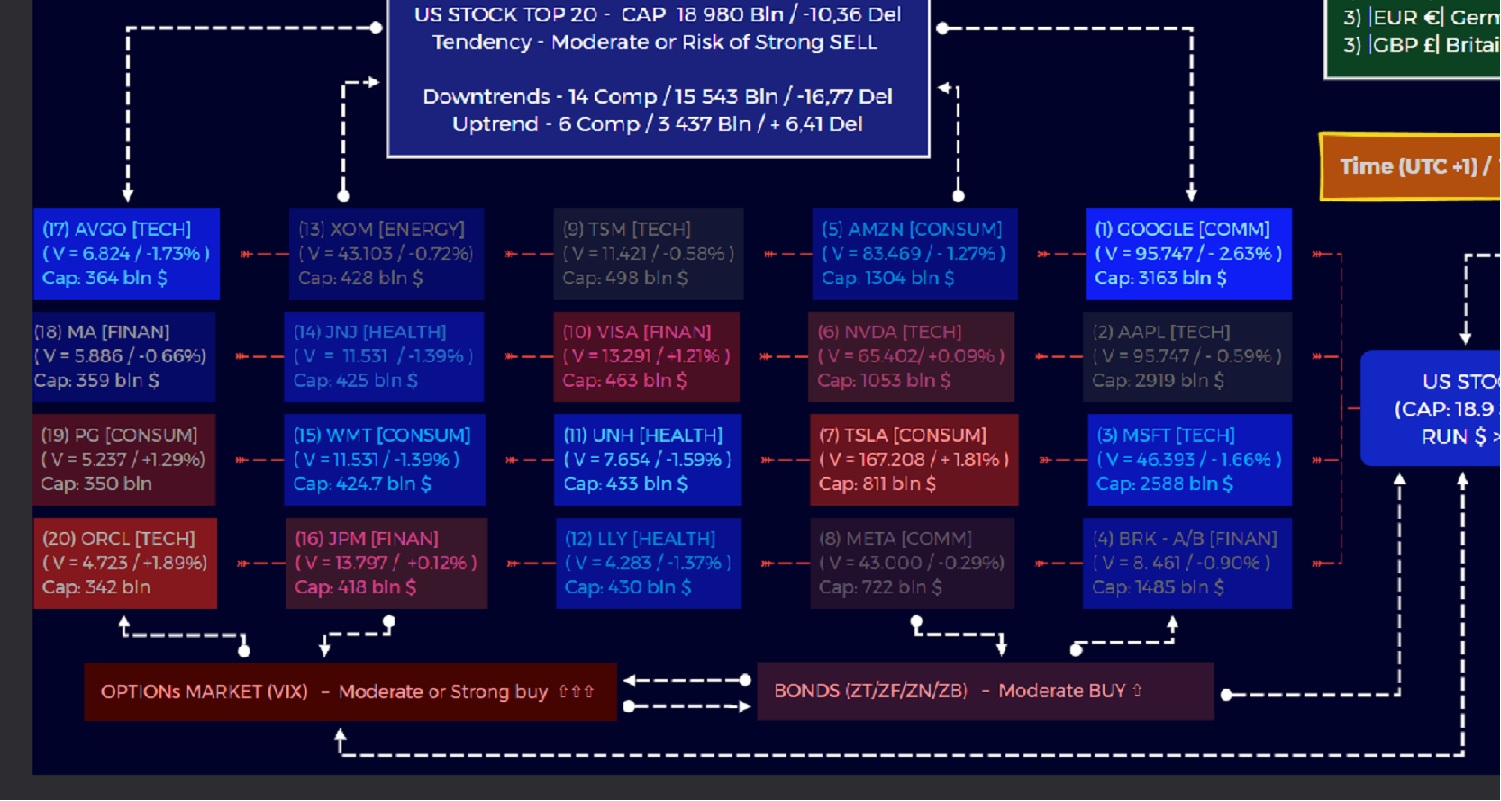

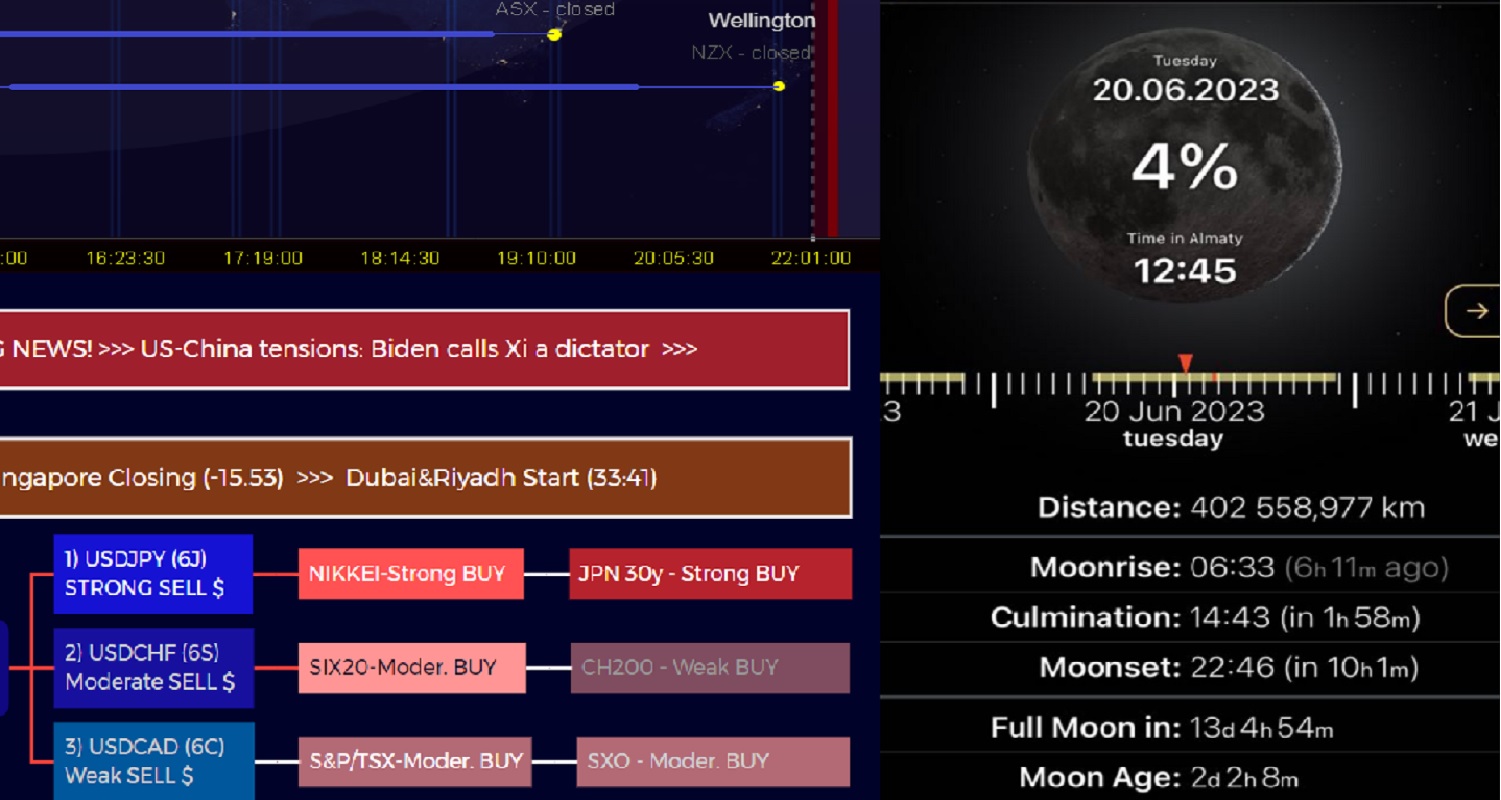

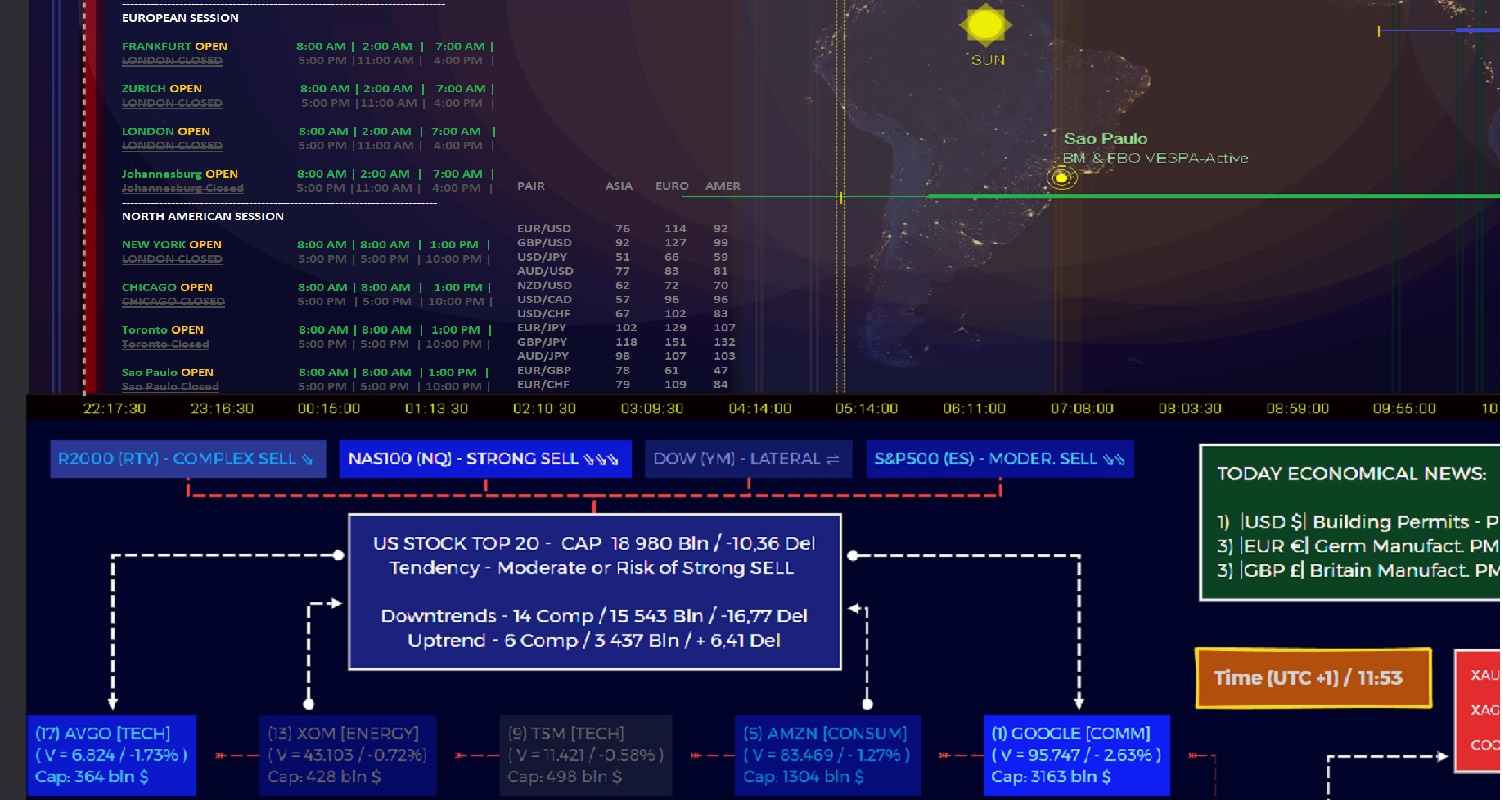

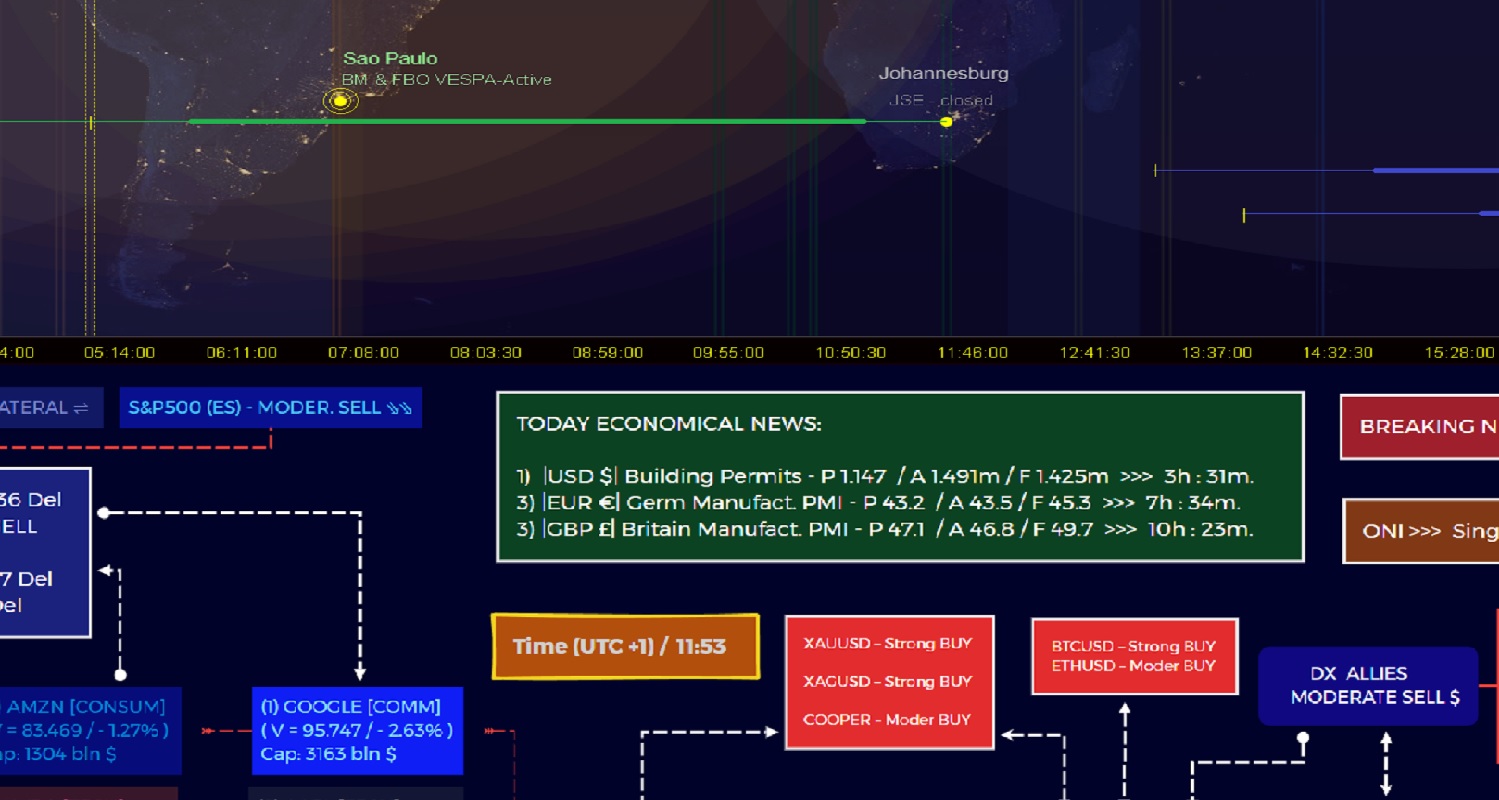

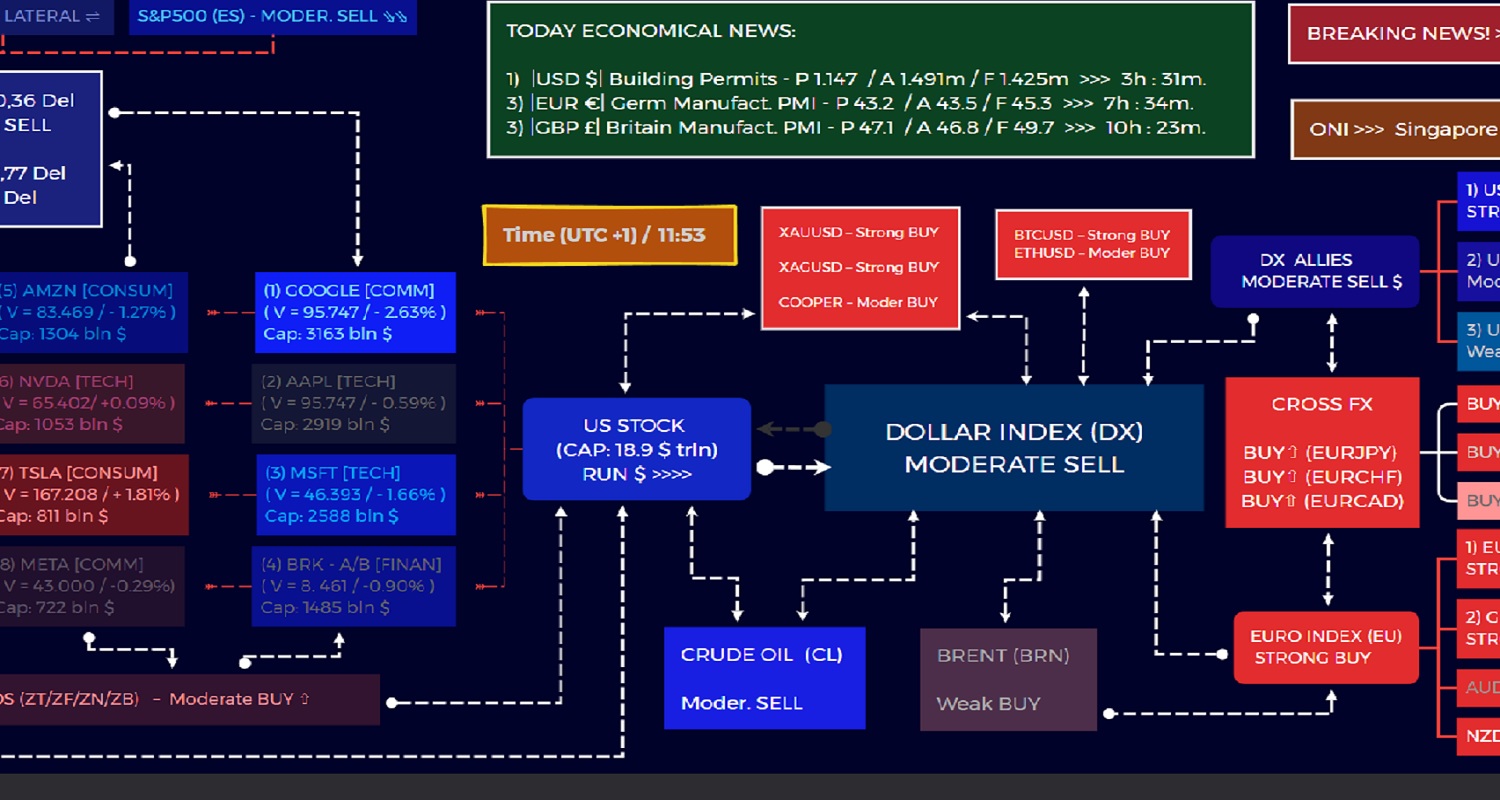

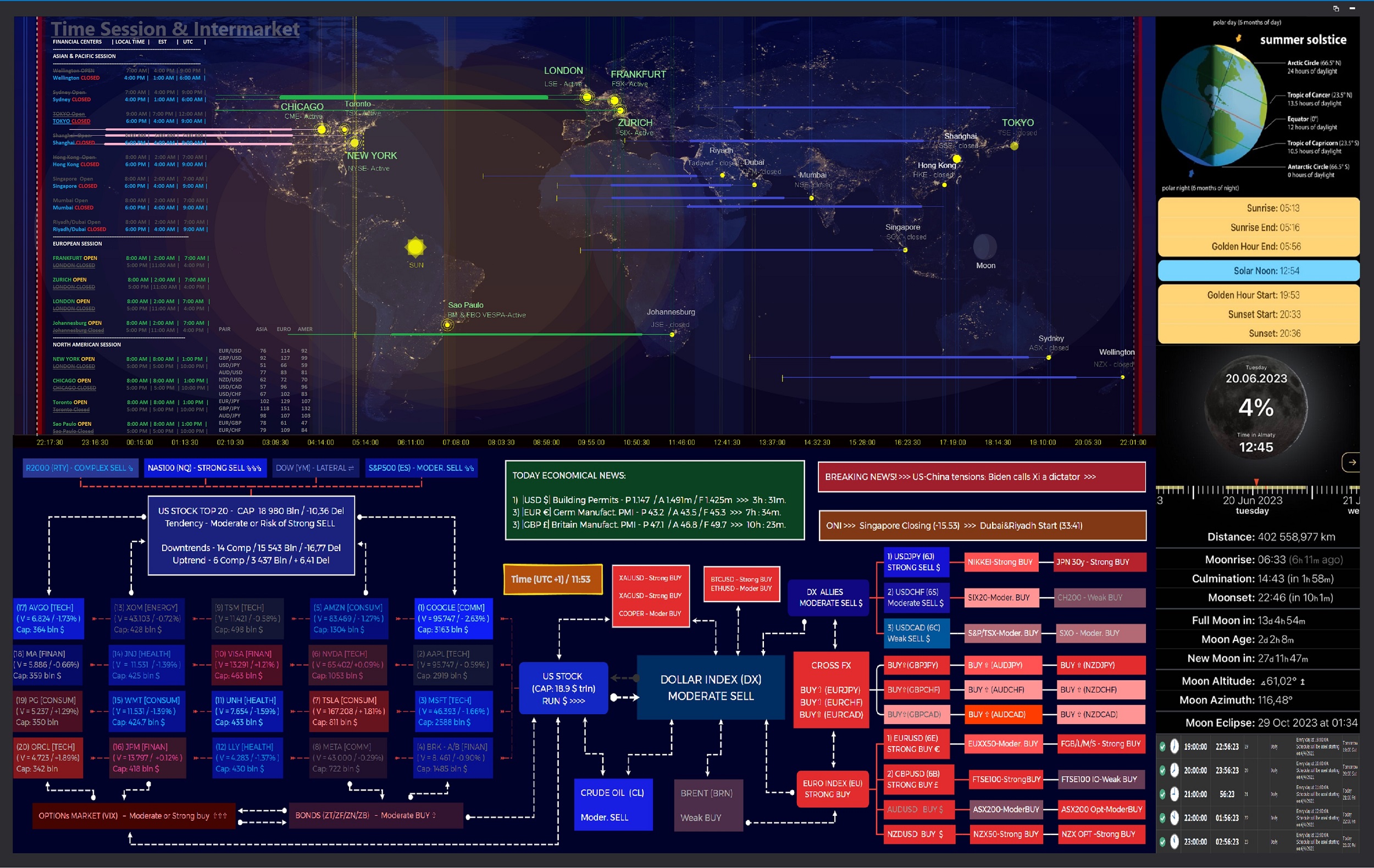

- Introduction to the “INTERMARKET ANALYSIS & TIME SESSIONS” algorithmic system

- Detailed acquaintance with indicators and algorithms of the system

SECOND SECTION: (min 4 – max 5 webinars)

- Introduction to the History of Intermarket events from 1980 to 2000 / Property of equal distribution of assets / The Importance of Chart Analysis..

- The relationship between the Commodity – Bond – Stock – Dollar markets / Reasons for the growth of Commodities and the fall of the Stock Market (Stories of Booms and Crashes).

- Convergences and Divergences of the Dollar in relation to the Stock Market.

- Convergences and Divergences of the CRB Index, Stock Market and Bonds.

THIRD SECTION: (min 4 – max 5 webinars)

- Geopolitics and it’s global correlation with Oil and Stock Markets.

- The Importance of CRB/JOC-ECRI/GS/, as well as GC and CL, in the Hidden Mechanisms of Bear Markets.

- Hidden Properties of Bear Markets: Examples of 1994, 1995 and 1998

- Asia Pacific Currency Crisis / Consequences of Stock and Fund Decorrelation / Deflation

FOURTH SECTION: (min 4 – max 5 webinars)

- The Importance of the “CRB & Bonds” Ratio and Its Impact on the Dynamics of Stock Market Sectors / Coherent Stocks

- The Fall of the CRB & Bonds Ratio in 1997 / Identifying ATR in Competitive Intermarket Sectors.

- Dynamics of Intermarket Trends / % rates and their impact on markets / Peaks and Reversals.

- Rising Oil Prices, Positive and Negative Impact on Companies in Different Sectors.

FIFTH SECTION: (min 4 – max 5 webinars)

- Interest rates and their impact on the Financial sector / Sector rotation and factors of the Economy.

- Interaction of Intermarket Trends at the Global Level / Asia and Semiconductors.

- Correlation issues between the Australian and Canadian economies.

- Introduction to the rules and principles of Intermarket Analytics / History / Evolution / Strategies.

SIXTH SECTION: (min 4 – max 5 webinars)

- Global Impact of the Asian Session on the European and American Sessions / Interaction of Global Sector Trends / Technical Properties and Nature of the Intermarket.

- Bilaterality of Market-Economic Forecasting / The Role and Influence of the Dollar on World Markets and Exchange Rates / Cyclicity of Intermarket Principles.

-

The Nasdaq Bubble Collapse of 2000 / History / Background / Inverse Yield Curve.

- REIT Index / Importance of CPI Index in Economy / Synchronicity of Copper and Long-Term Rates.

SEVENTH SECTION: (min 4 – max 5 webinars)

- Nasdaq – Lessons and Conclusions / Sector Dynamics during Growth and Recession of the Economic Cycle.

- Indicators of Fear / Bonds vs Commodities & Stock / Stocks as a Leading Indicator.

- Gold Market / History and Evolution / Gold vs Inflation / Reversals and Trends / Gold Mining Sector.

- The Fed Era / History and Evolution / Balance of $ & Bonds / Mechanisms of influence and stimulation of the economy / Greenspan A. – Bernanke B.

ALGORITHMIC SYSTEM

“INTERMARKET ANALYSIS & TIME SESSIONS” (II PART)

EIGHTH SECTION: (min 4 – max 5 webinars)

- Balance, growth and decline of the Dollar as a bijection of stimulating the growth of the Commodities market.

- Inflation and Deflation / Wars and Force Majeure / Weather Factors / Violation of the Interaction between Bonds & Commodities

- Deflation and Interest Rates / Commodity Prices / Bond Yields / Global Bear Market.

- Deflation and Commodities / Analysis methods for identifying trends and corrections in any markets.

NINTH SECTION: (min 4 – max 5 webinars)

- Price Considers Everything / Examples of Intermarket Interaction / Cycles and Trends

- A Historical Study of Market Cycles / The Consequences of the Global Dollar Fall for the World Economy.

- China Out of Dollar’s Negative Move / Global Commodity Supply / Yuan Revaluation

- Correlation of Commodities and Commodity Currencies / Differential Portfolio Commodities & Currencies

TENTH SECTION: (min 4 – max 5 webinars)

- Introduction to the History of Futures Markets / Asset Allocation / Asset Class RSI

- DJIA & Gold Ratio / Commodities & Currencies Differential Portfolio

-

Theories and Methods of Futures Market Analysis / John Lintner’s Doctrine / Pros and Cons of Correlation

- Dollar and Gold vs. Currency Basket / Divergences and Convergences

ELEVENTH SECTION: (min 4 – max 5 webinars)

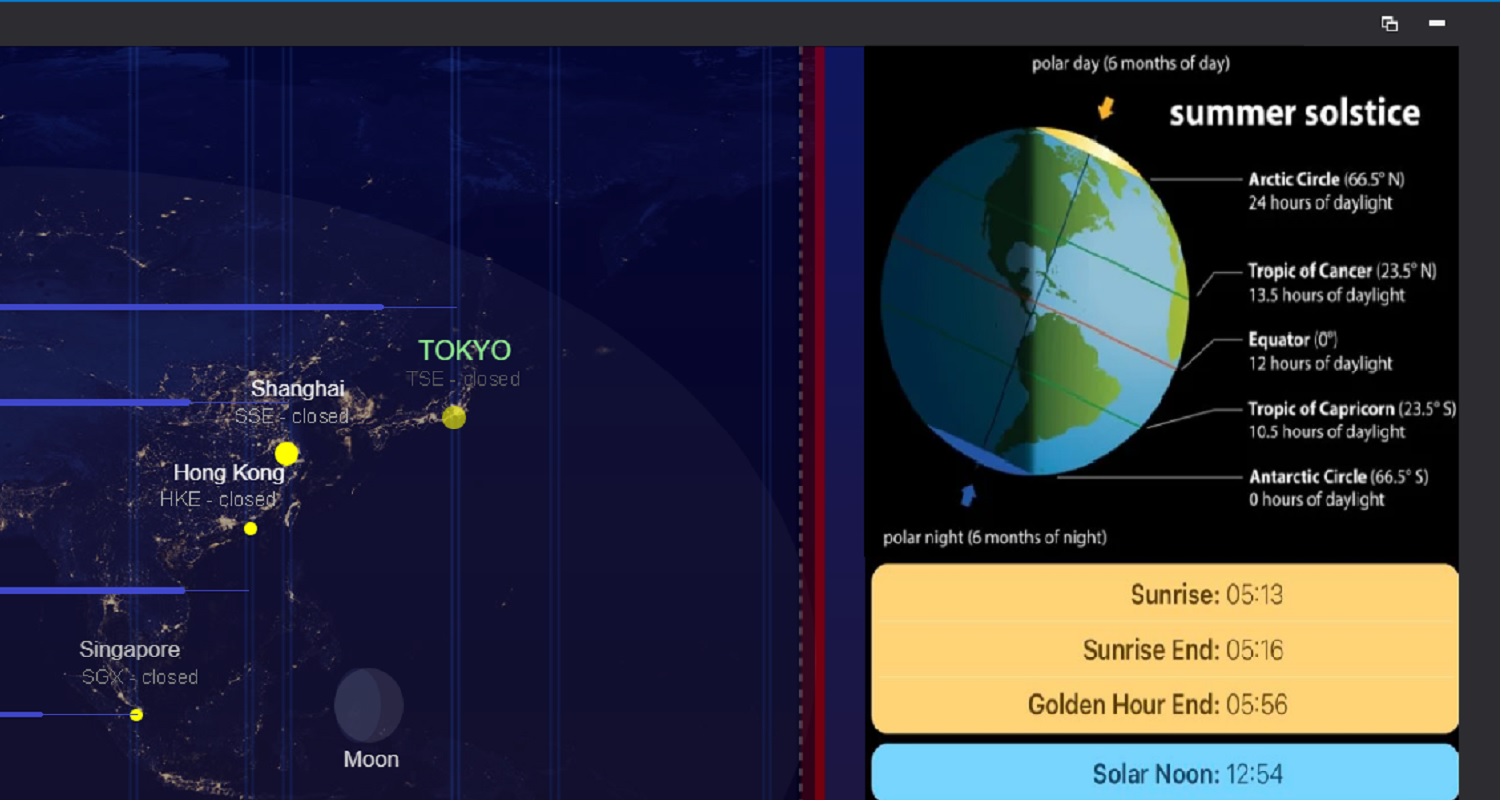

- Essay on astrological and astronomical history / The Influence of the Sun on Eukaryotes / The Influence of Lunar Cycles

- Evaluation of 11 – 22 – 44 – 55 year cycles / Kitchen / Juglar / Simon – Kuznets

- Six Stages of Economic Cycles / Presidential Cycle / Chronology and Interactions

- Leading Economical Indicators / Trends 17 – 27 / JOC Index / S&P500-Bonds-Commodities price synchronization result

TWELFTH SECTION: (min 4 – max 5 webinars)

- Market peaks and troughs / Properties of market relationships / Synthesis and decoupling of the Intermarket

- Dynamics of sectors during the Economic cycle / Cycle doctrine of S. Stovall / Rotation of sectors as a harbinger of a trend reversal / Properties of Russel 2000

- Retail Price Index / Periods of Leadership by Sectors / Moments of Superiority of Cyclical Stocks over Stocks of Consumer Goods Producers

- Interest Rate Property / The Fed and the Yield Curve / The Fed and Bonds

THIRTEENTH SECTION: (min 4 – max 5 webinars)

- Real Estate in a Differential Portfolio / REIT Index vs. Stock Market.

- Real estate and the relationship with interest rates / K. Long cycle / Deflationary cycle.

- House Building Companies / History and Evolution / Divergence from the Stock Market / Intermarket Relationships and Interactions.

- Fed – Deflation and Rising Home Builder Stocks / Japanese Real Estate Market Crash.

FOURTEENTH SECTION: (min 4 – max 5 webinars)

- SYMBIOSIS of TRADING and “INTERMARKET ANALYSIS & TIME SESSIONS”.

- GLOBAL ANALYSIS OF THE FUTURE on the subject of INTERMARKET DISCIPLINE.

- “F.A.Q” – Frequently Asked Questions / Dialogues / Explanations.

- RECOMMENDATIONS and ADVICE.

- Duration of study (approximately):

- 60 webs / 90 hrs / 20 weeks / 5 mnths

- INDIVIDUAL TRAINING: