VIP trading course:

“OPTION MARKET”,

based on the revolutionary

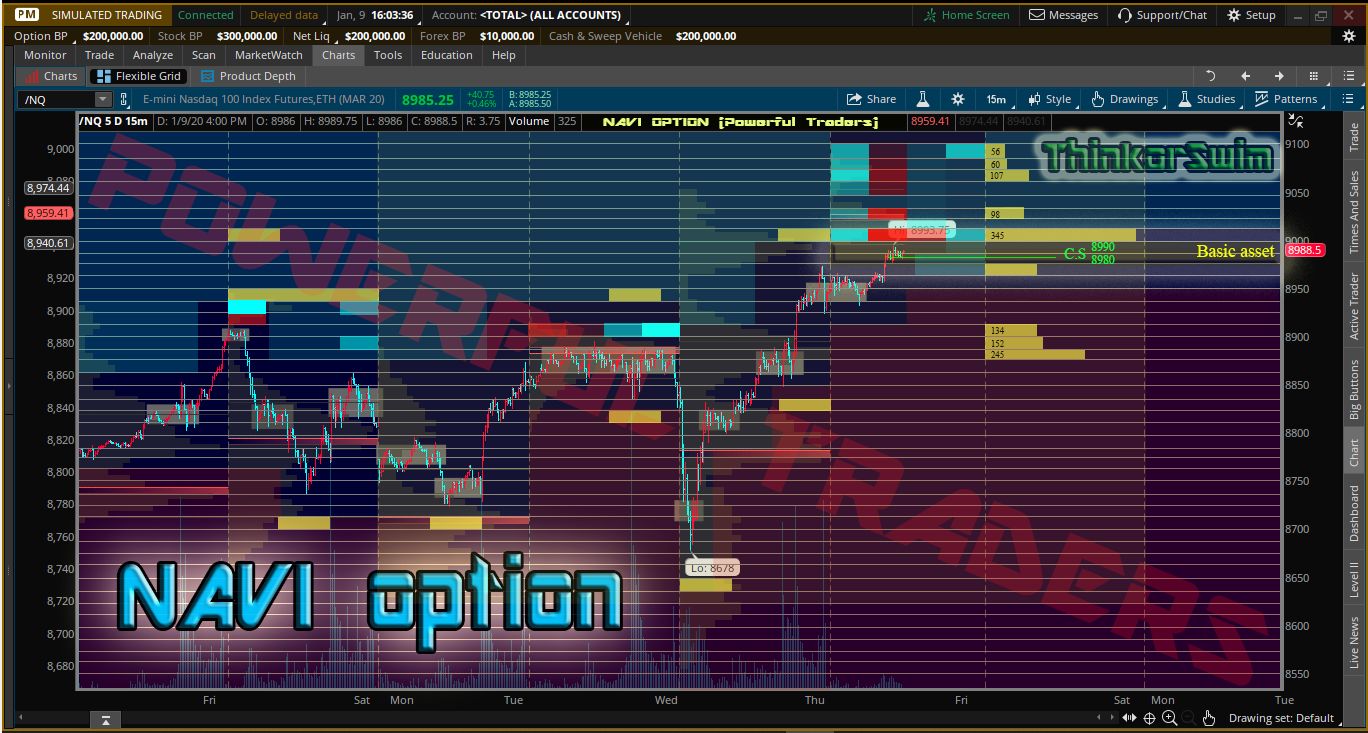

“NaviOption” algosystem

VIP COURSE PROGRAM:

FIRST SECTION: (min 8 – max 10 webinars)

Introduction to the option market:

- The history and introduction to the options

- Basic information of the options

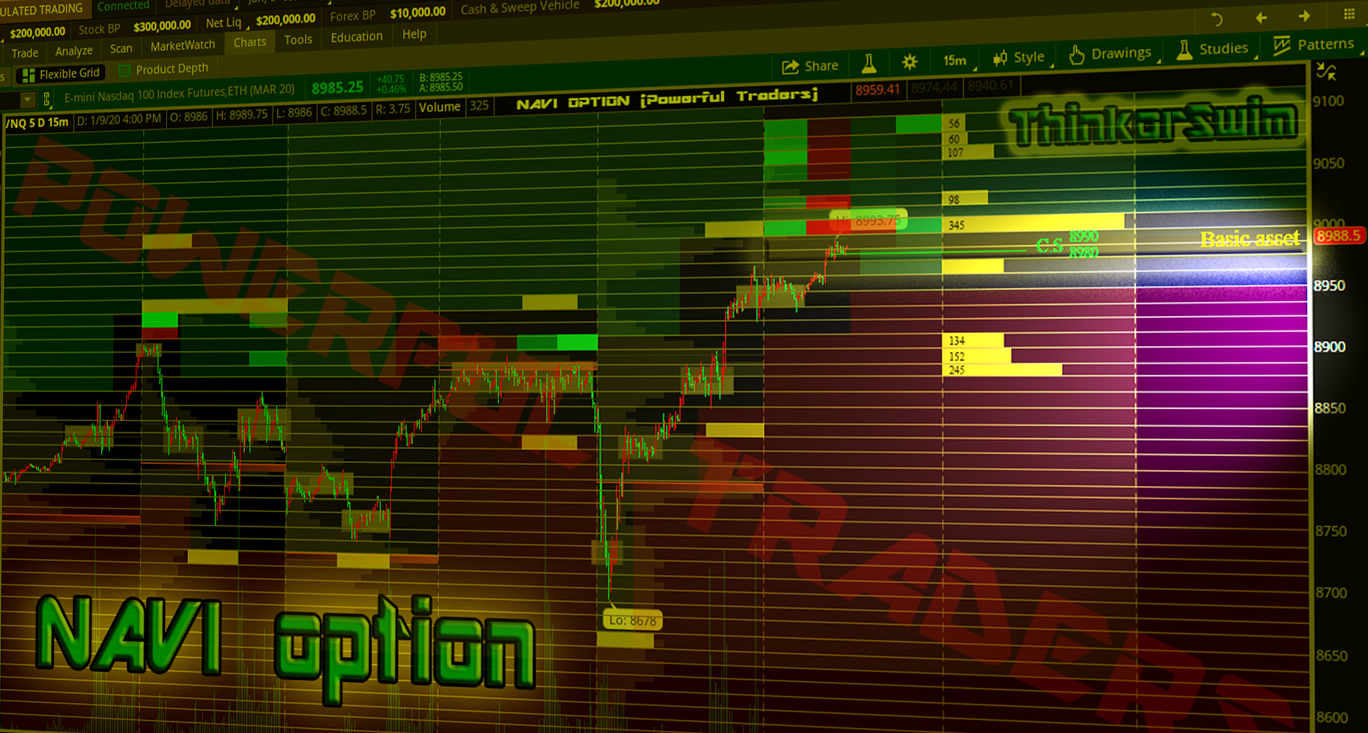

- Trading terminal “THINKorSWIM”, complete instructions

- The “Call/Put” options’ basic strategies

- Introduction to the term of “Volatility”

- The types of Option Markets

- Additional Information

- Conclusion, recomendations & advice

THIRD SECTION: (min 10 – max 12 webinars)

Basis and properties of the “Greeks”

- “Volatility” (types and properties)

- “Delta” (main parameters)

- “Delta Hedging”

- “Vega” (main parameters)

- Properties and changes “Vega”

- “Theta” (main parameters)

- Delta time decay difference

- Influence on “Theta” secondary parameters

- “Gamma” (main parameters)

- Significance of the “Gamma” Properties

FIFTH SECTION: (min 12 – max 14 webinars)

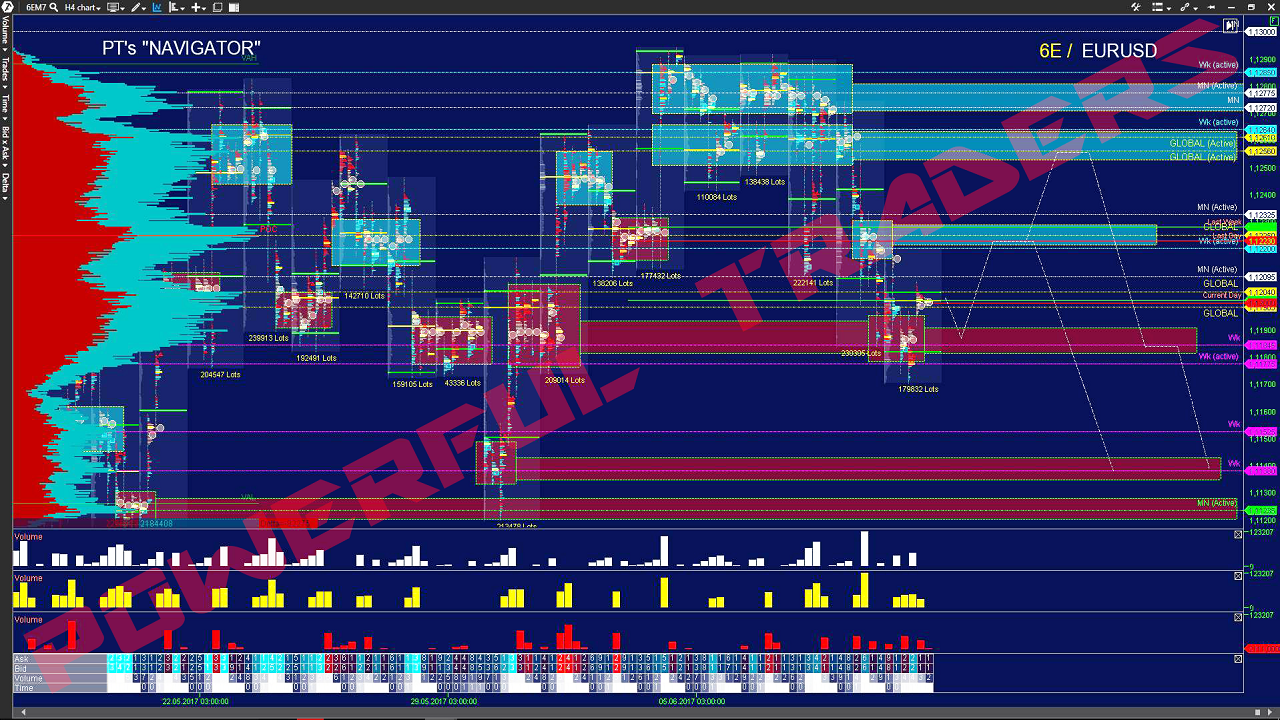

Symbiosis of Volume&Cluster Analysis and Options

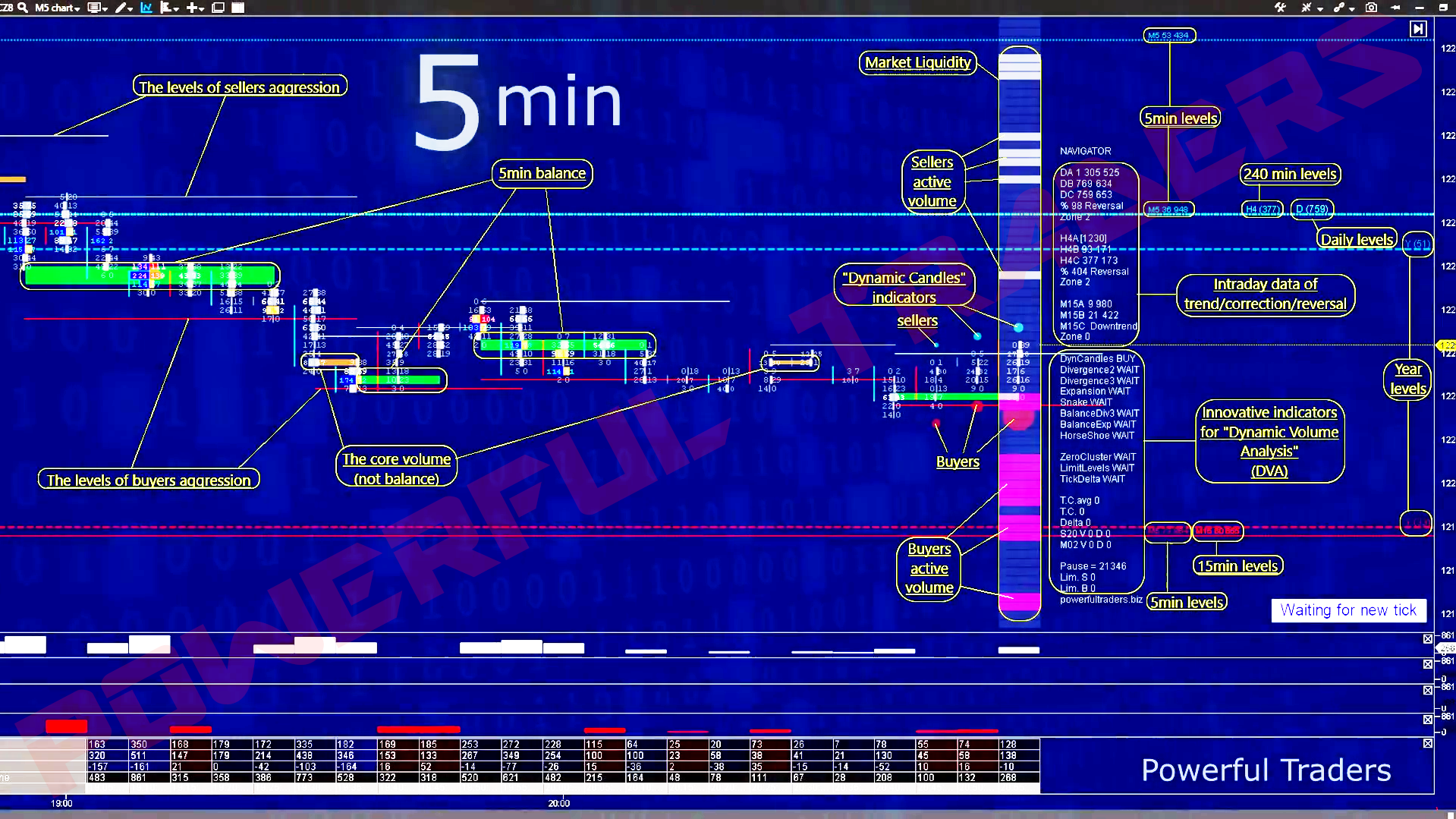

- Intoduction to the symbiosis of Volume&Cluster analysis and Options

- The Volume&Cluster analysis, “BA/UA” and Options

- The Volume&Cluster analysis and Volatility

- The Volume Cluster Analysis and Options Expiration

- Cumulations of the major auctions in the context of “BA/UA” and Options

- Small cumulative liquidity of “BA/UA” withing the properties of Weekly Options

- The Influence of Volume&Cluster analysis on Directional strategy in the Options’ trading

- Weekly activity & Intraday sessions of “BA/UA” in the context of changes of an intrinsic and extrinsic values

- The influence of “BA/UA” volumes in the synthesis of classical option strategies

- Options’ hedging strategies in the context of the Volume&Cluster analysis of “BA/UA”

- The practice of buying/selling an options in the context of Volume&Cluster analysis

- Conclusion, basic recommendations and advices

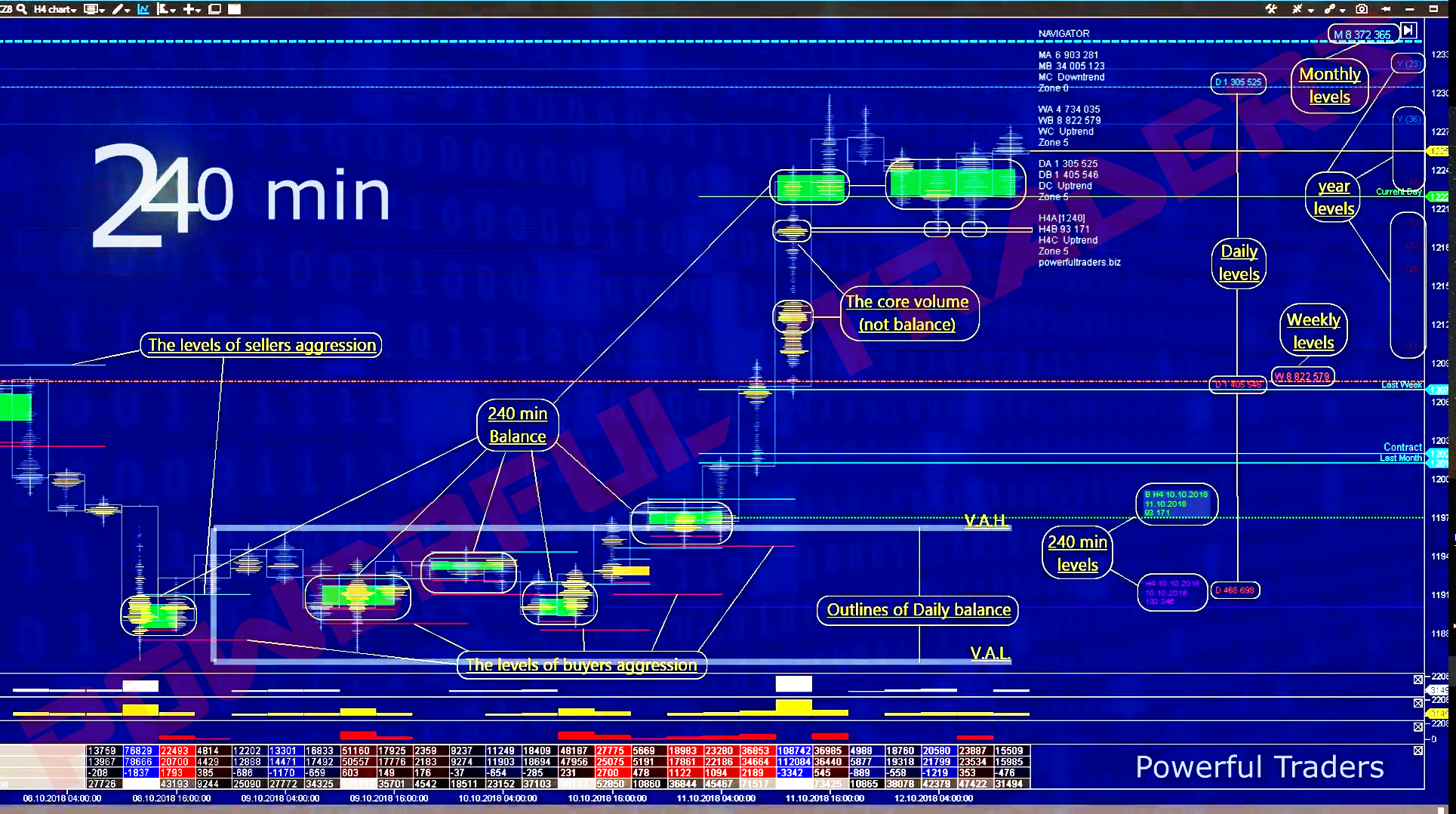

- Properties of “Zones 0 – 5” in synthesis with “Market Profile” and spread of strikes.

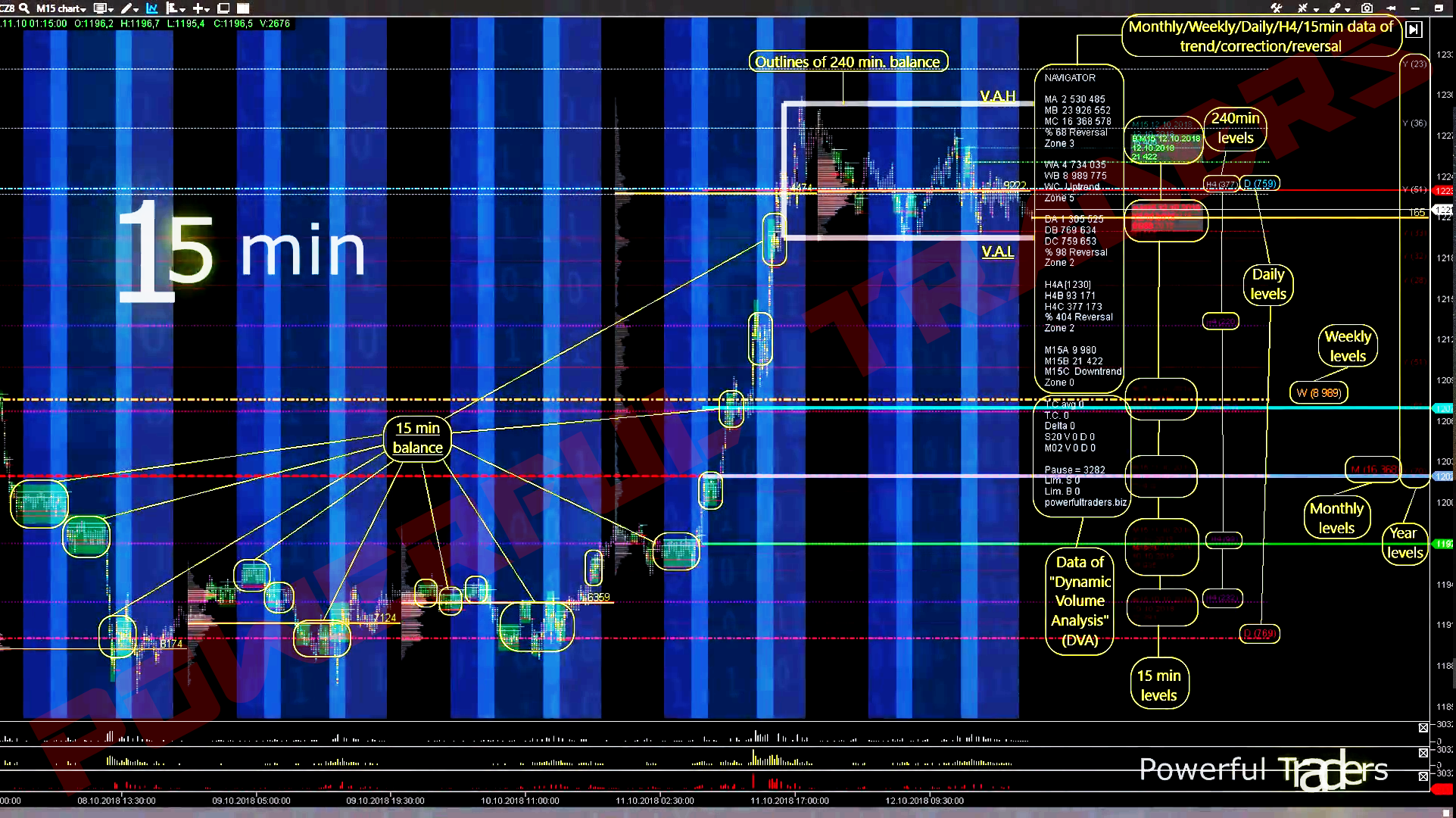

- The effect and properties of dual levels of “MN”, “WK”, “Daily”, “240 min”, “15 min” timeframes on “BA/UA” and their influence on the “Volatility”

- The effect of “BA/UA” gravity liquidity , according to the estimation of “Planet-satellites” and their influence on options

- More precise definitions of “expected”, “historical”, “expected-historical” volatility in the synthesis of the “Navigator II” algosystem

- Session interactions and their impact on the intrinsic and extrinsic values of weekly options in the synthesis of dynamic levels of the “Navigator II” algosystem

- The volatility prediction and dynamic changes of the “Greeks” when using the “Navigator II” algosystem

- Liquidity calculation and trend definition for long / middle / short-term investment in options

- Conclusion, recommendations and advices

- Timeframe “SPPGH” (Simulated Price Prediction & Greeks Heatmap), forecast map with extraction of the final change of the “Greeks” and the price of “BA/UA” in the linear space of the price and time scale

- Dynamic indicator “DOM & OLS” (Depth of Market & Option Liquidity Scale), the DoM and global scale of option’s liquidity

- Dynamic indicator “FPP” (Future Price Prediction), a cyclical price predicting indicator with the visualization of future areas of a price reversal & stop

- Conclusion, recomendations and advices for the course “NaviOption”

SECOND SECTION: (min 11 – max 13 webinars)

Option – classic strategies

- The options expiration

- Simple optional strategies

- Risk parameters in option trading

- The basic types of hedging positions

- Market risk management

- The role of Marketmakers in the option market

- Option’s complex combinations

- Long / medium term investment

- Short-term option’s trading (weekly options)

- Credit Risks and Options

- Sociobiology and Psychology in Trading

FOURTH SECTION: (min 12 – max 14 webinars)

Symbiosis of the Wave Theory and Options

- The symbiosis of wave theory and options

- The Wave Theory, Basic asset (BA/UA) and the options

- The Wave Theory and “Volatility”

- The Wave cycles and Option’s expiration

- The Wave Corrections and Options

- Small Wave Cycles within the the week term options

- Determination of wave tendency in directional strategy in the option trading

- Influence of Waves Theory on the option’s changes in the intrinsic and extrinsic values

- The wave multivariance in the synthesis of option’s strategies

- Options Hedging strategies in the Context of Wave Theory

- The practice of buying / selling an options in the context of the Wave theory

- Conclusion, basic recommendations and advices

SIXTH SECTION: (min 18 – max 20 webinars)

Algosystem “Navigator II” and the Options Market

- Property of balances and cores’ liquidity withing the “BA/UA”

- Dynamic support / resistance levels of ”BA/UA” in the spectrum of the “Navigator II” algosystem

- The degrees of the hierarchy of balances, the time of cumulative cycles and their impact on the options’ intrinsic and extrinsic values

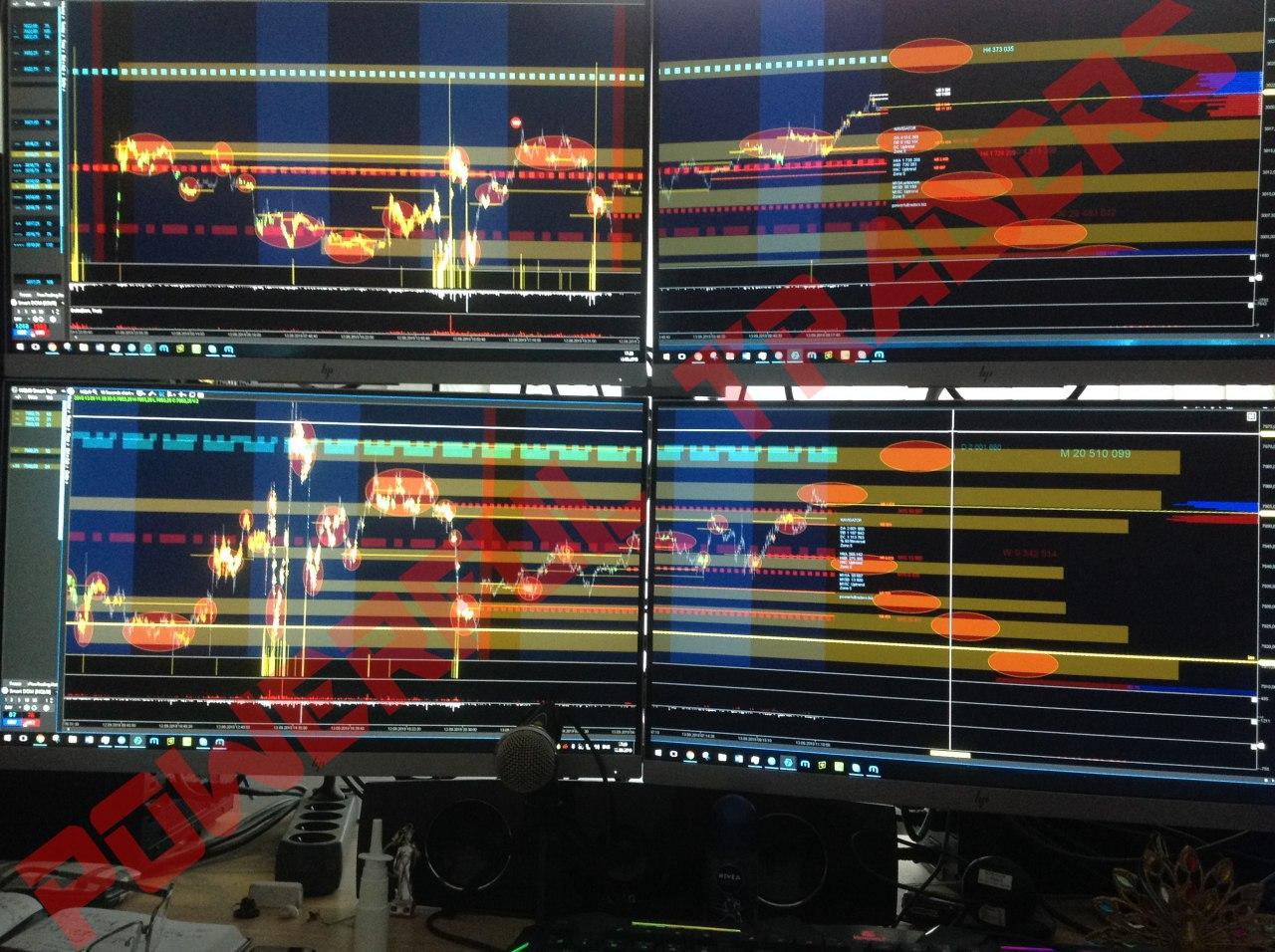

- Synchronization of levels by degree of priority: Year, Month, Week, Day, 240 minutes

- “Navigator II” algosystem: different chart menu & changing levels’ parameteres

- Daily “Mood’s thermal gradient map” of the “BA/UA” players and their influence on Options’ ”OTM”, “ATM” and “ITM” within the 15 minute timeframe

- Specific definition of the weekly trend in short-term options trading.

- The boundaries of the “BA/UA” aggressors, within the intrinsic value and the spread of option strikes

- The principles of “Powerful Traders’ DOM ”and it’s interaction with “MN”, “WK”, “Daily”, “240 min” and “15 min” timeframes

- “BA/UA”: Theory A = B = C phases, reverses and the continuation of the trend from senior to junior auctions and it’s influence on the Option’ Market

SEVENTH SECTION: (min 10 – max 12 webinars)

The “NaviOption” algosystem

- Installation instructions, starting the “NaviOption” algosystem

- Basic introduction and Menu Functions of the “NaviOption” algosystem

- Dynamic indicator “LTEHO” (Long Term Expiration Heatmap Options) for long-term investments

- Dynamic indicator “MTEHO” (Middle Term Expiration Heatmap Options) for medium-term investments

- Dynamic indicator “STEHO” (Middle Term Expiration Heatmap Options) for short-term speculation

- Dynamic indicator “DVOIL” (Dynamic Volume & Open Interest Levels), a global dynamically changing map of support / resistance levels of options and liquidity accumulations

- Dynamic indicator “GHS” (Greeks Heatmap Scanner) the map of the “thermal gradient” which displays decay and change of the “Greeks ”

Education time (approximately) :

95 webinars / 190 hours / 48 weeks / 1 year

INDIVIDUAL COURSE: