PROFESSIONAL COURSE

“EXPRESS TRADING EDUCATION”

FIRST SECTION: (min 1 – max 2 webinars)

- Getting to know Motivewave & Tradingview workspaces.

- Installing the necessary indicators

SECOND SECTION: (min 3 – max 4 webinars) – EWA/EWP

- Introduction to the history of wave theory / Impulse waves (Extension & Failure) / LDT & EDT

- Introduction to Correction / Zigzags (Odinary / Double / Triple), Lateral (Odinary / Double/ Triple) / Correction “Flat”

- Triangles and their types / Irregular corrections according to R. Balan / Substitution of structures

THIRD SECTION: (min 3 – max 4 webinars) – Technical

- Regression Depth in Corrections / Binary Correction Properties / Symmetry in corrections

- Determining the start & end of a trend / Price orientation in space, from global to local component

- Definition of long / medium / short term trends

FORTH SECTION: (min 3 – max 4 webinars) – Harmonical

- Introduction to harmonic trading / Bill Wolfe Waves / Harold Gartley Patterns

- Essay on Gann’ Astrotech / Influence of the Sun on a person & society / The impact of the Moon cycles

- The impact of the Moon cycles / Sociobiology essay

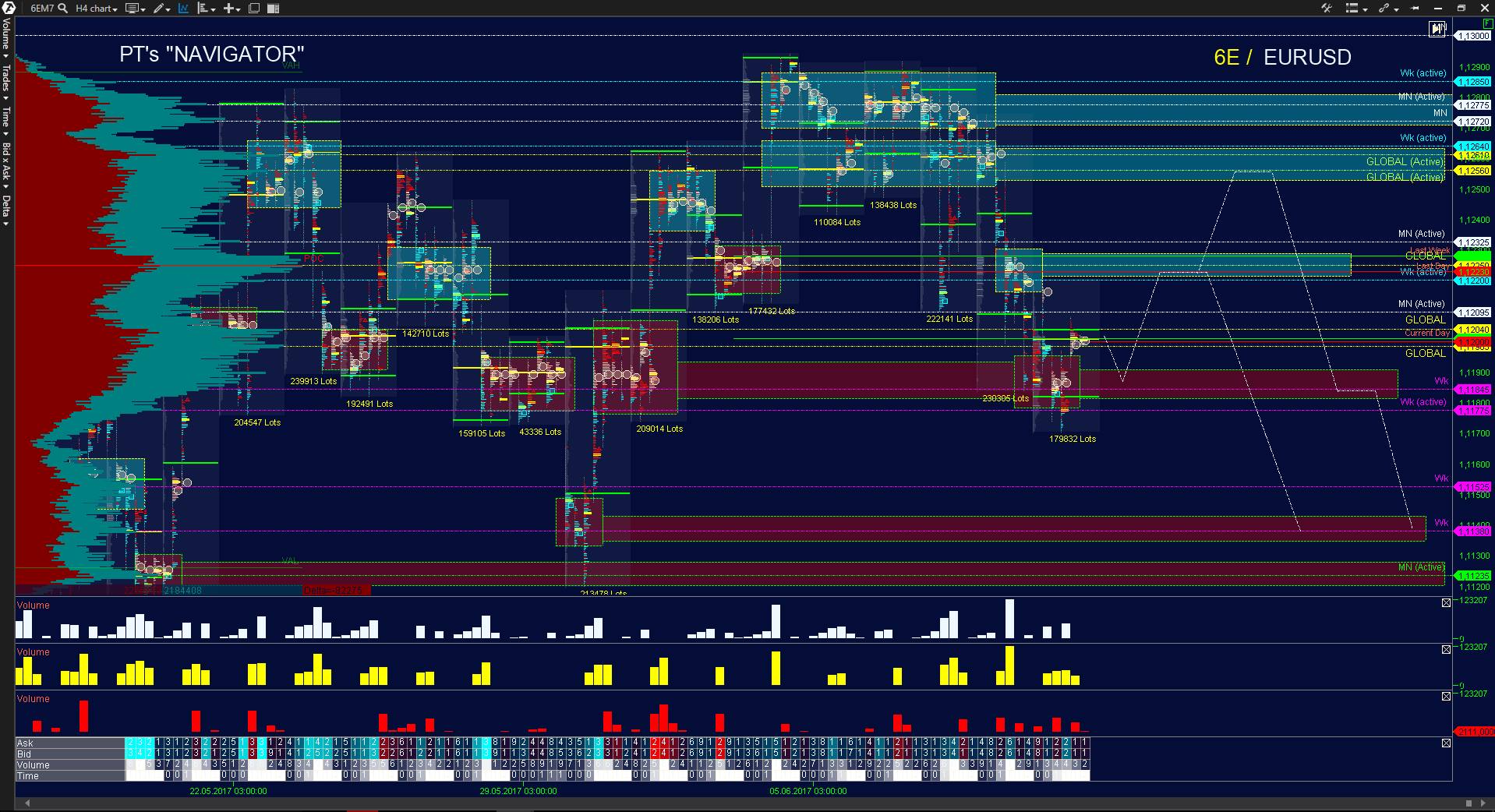

FIFTH SECTION: (min 3 – max 4 webinars) – Navigator

- Installation procedure “Navigator”/ Introduction of menus and functions

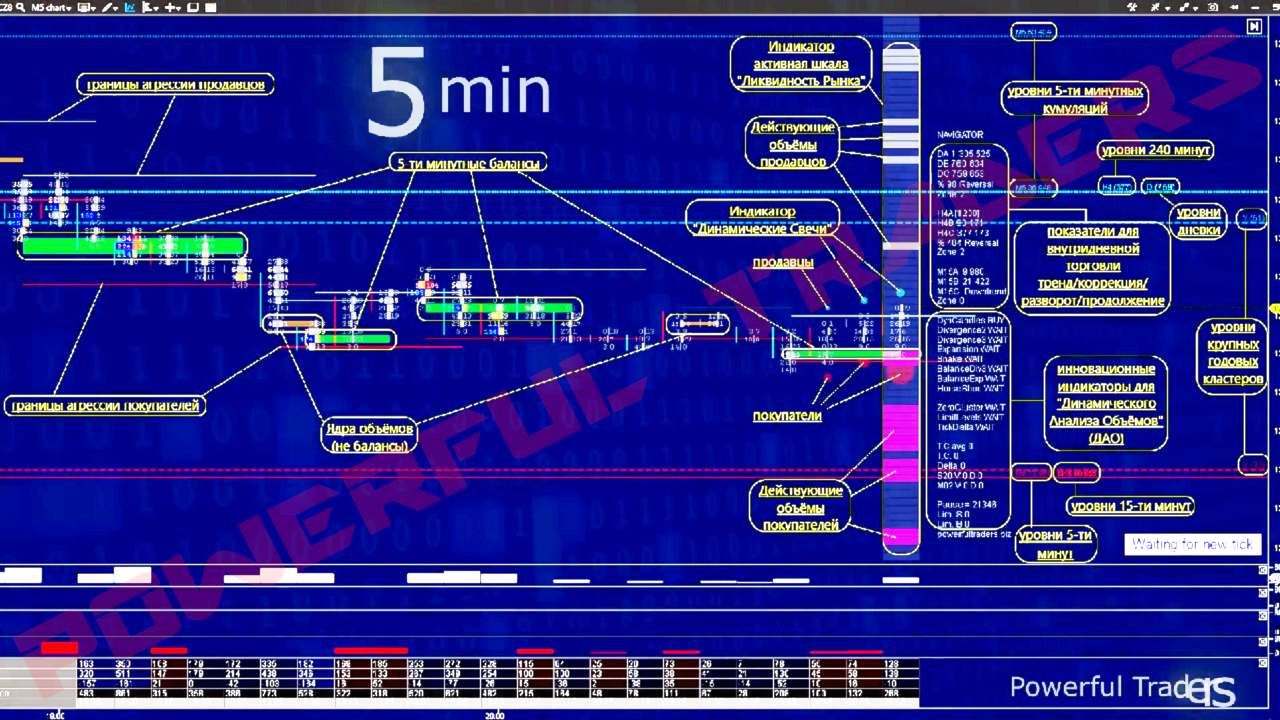

- Understand the details of the monthly / weekly / daily / 240 minutes / 15 minutes / 5 minutes charts templates, Theory A = B = C phases, reverse and continuation of the trend, Zone 0 – 7 properties by market profile

-

Introducing the revolutionary Dynamic Analysis indicators: “Dynamic Candles”, “Divergence2”, “Divergence3”, “Expansion”, “Snake”, “Balance Div3”, “Balance Expansion”, “Horse Shoe”, “Zero Cluster”, “Limit Levels”, “Limit orders”

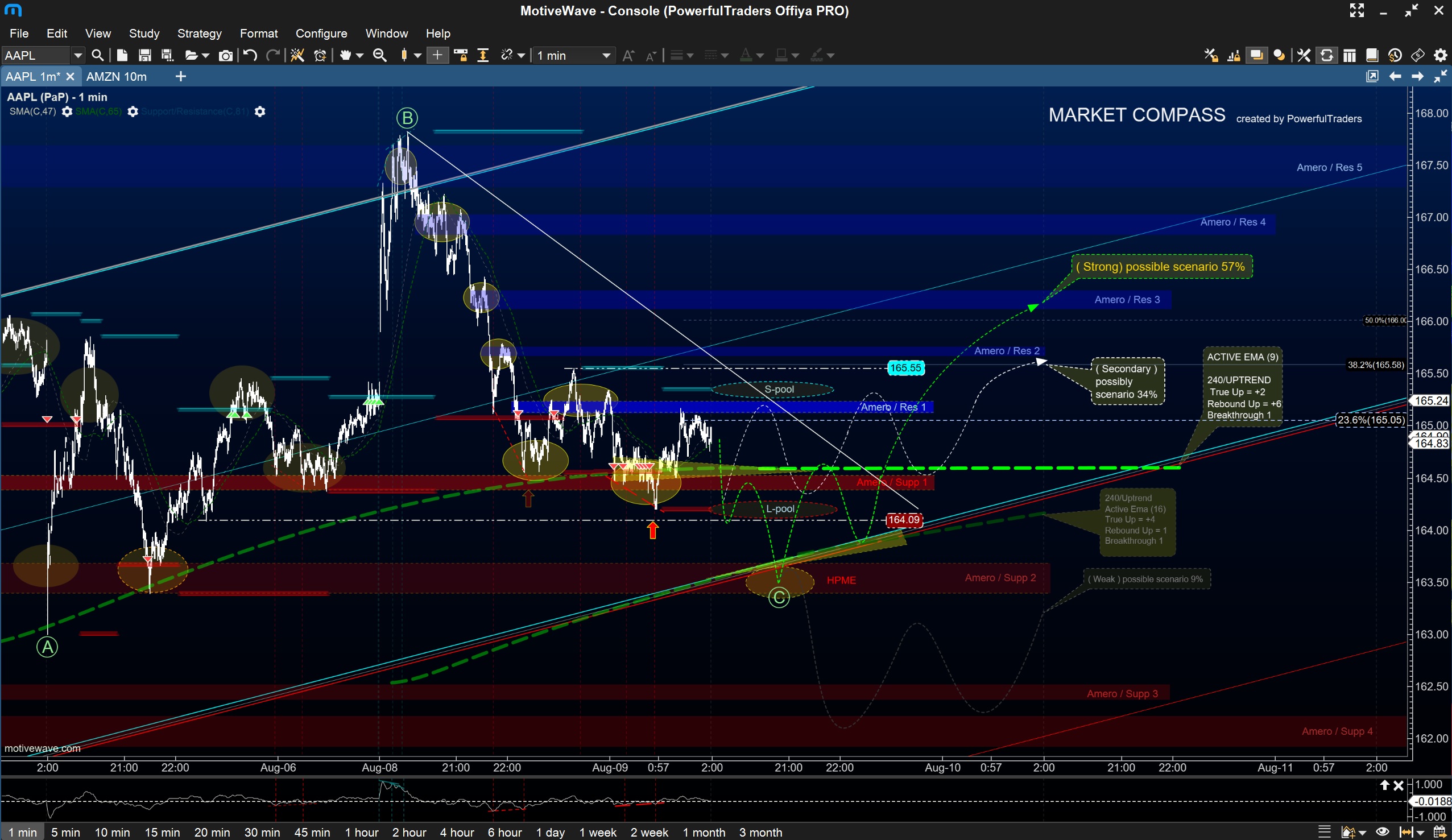

SIXTH SECTION: (min 3 – max 4 webinars) / Market Compass

- Configuring the “Market Compass” algorithmic system / Introduction of menus and functions

-

Symbiosis of interaction between automatic “EMA” & “Navigator II” / Automatic Channel of regression, understanding of internal properties and ways of building based on auction & volumes

-

“Daily Volatility ATR” indicator – internal properties & search for the beginning and end of daily micro trends

SEVENTH SECTION: (min 3 – max 4 webinars) – Options

- The history and introduction to the options

- Basic information of the options

- The types of Option Markets

- Additional Information

- Conclusion, recommendations & advice

EIGHTH SECTION: (min 3 – max 4 webinars)

- CONCLUSION OF THE COURSE

- “F.A.Q” – Frequently Asked Questions

- Dialogue, answers to the questions of the trader / traders

- Education time (approximately) :

- 25 webs / 38 hrs / 8 weeks / 2 mnths

- INDIVIDUAL COURSE: