PRO trading course

“Volume Spread & Cluster Analysis”

(expanded version)

VIP COURSE PROGRAM:

FIRST SECTION: (min 3 – max 5 webinars)

INTRODUCTION:

- Acquaintance with the Trader and assessment of the level of knowledge

- Introduction to the course of volumetric analysis

- Getting to know the terminal workspace

- Desktop settings, recommendations

THIRD SECTION: (min 7 – max 9 webinars)

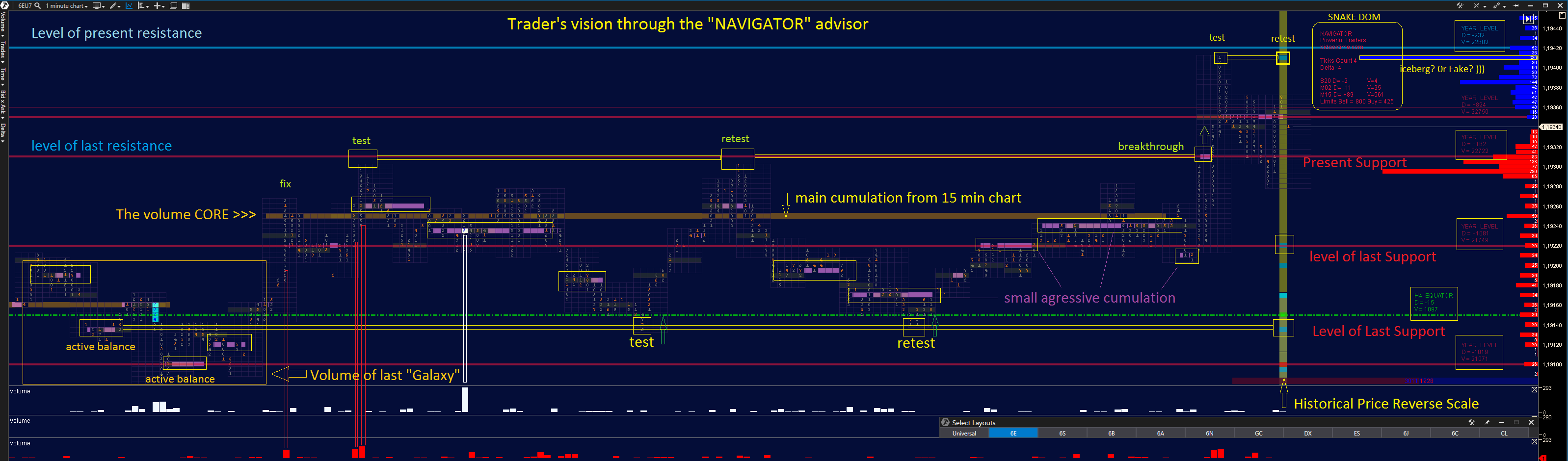

“PROFESSIONAL DOM” (extended order book)

- Acquaintance with an extended order book

- Execution of orders, the difference between pending and orders on the market

- The classic ranges of the accumulation of stop orders

- The degree of importance of current and past cumulations in conjunction with the spread

- Diversification and price dynamics in conjunction with different degrees of cumulation

- Determination of levels of protection, true and false breakdowns

- iceberg and fake orders, classic locations

FIFTH SECTION: (min 7 – max 9 webinars)

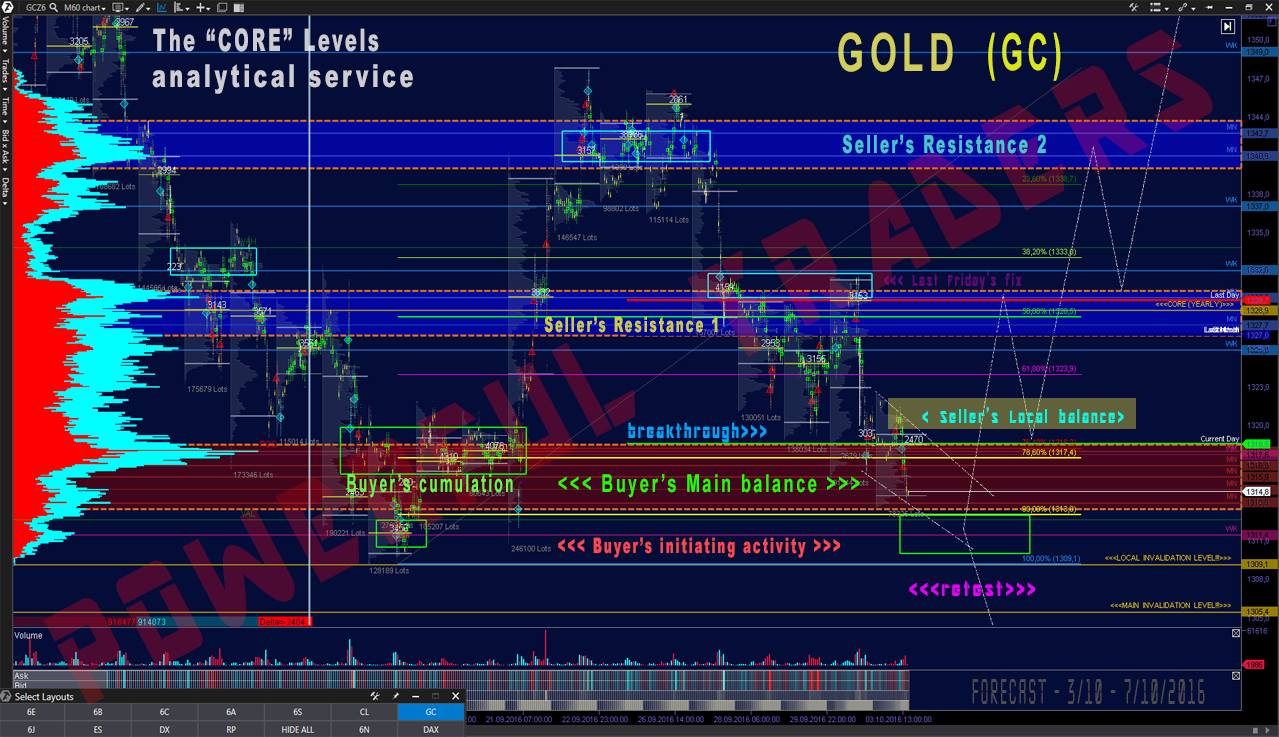

“FOOTPRINT” 1 part

- Basic footprint basics

- Distribution of volumes and large orders in a clustered environment

- Nature and cyclical changes in the volume in the dynamics of the day

- The nature of cyclicality and changes in the volume for the week

- Divergence of volumes and price as a harbinger of reversal

- Basis and delta definition

- Delta Dynamics in OHLC

SEVENTH SECTION: (min 8 – max 9 webinars)

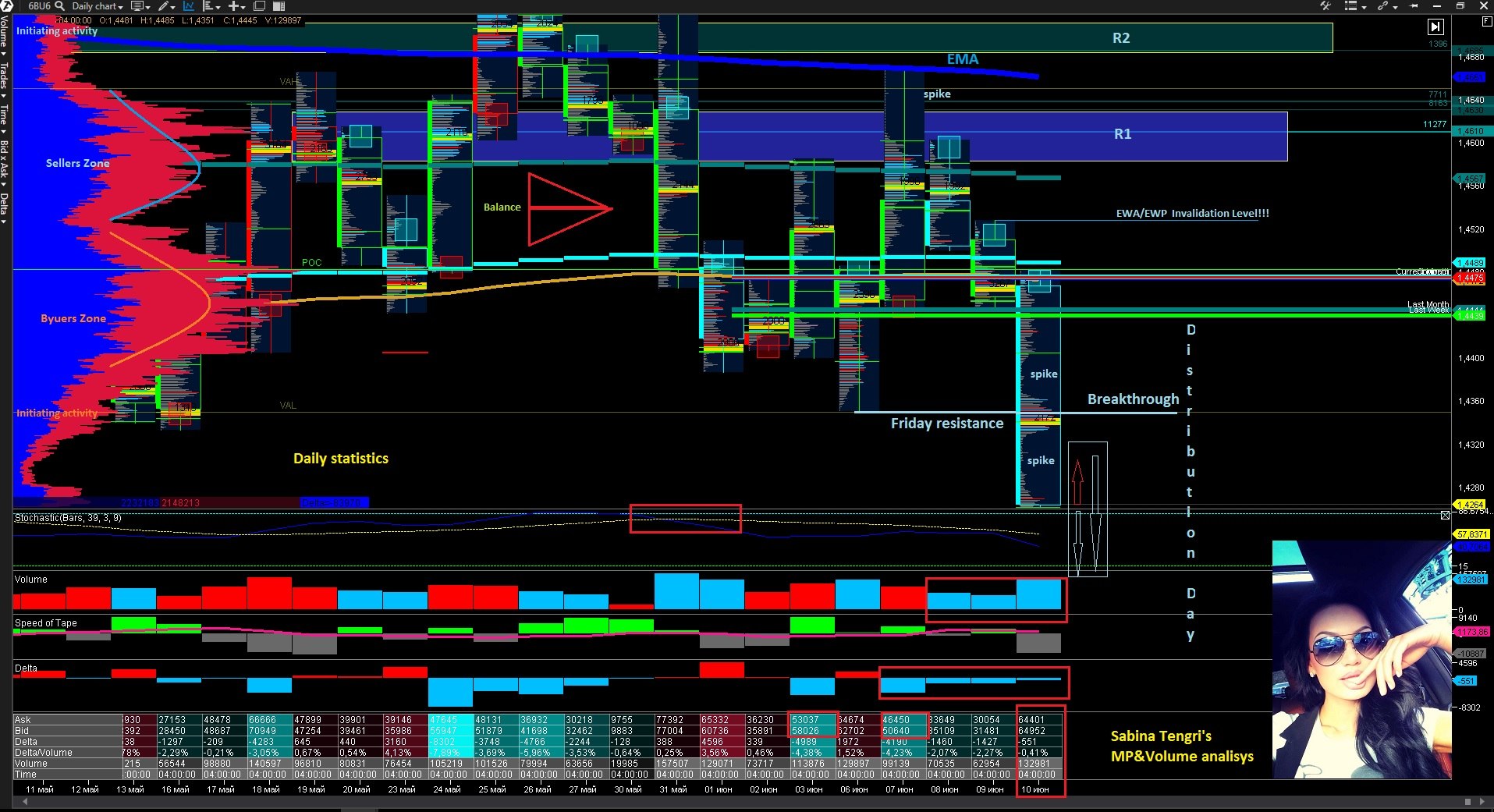

“MARKET PROFILE”

- Founders of the VSA – Richard Wyckoff, Tom Williams

- Market Profile – Peter Steidlmayer

- Time Price Opportunity (TPO)

- Types and calculation of the histogram 15% / 70% / 15%

- Identification of the “Fair Price” zone POC and VAH, VAL

- Ranges “0-7” and the territory of the aggressors

- Symbiosis “VSA” and “Market Profile”

- Balances and cores in the context of the “Market Profile”

SECOND SECTION: (min 5 – max 7 webinars)

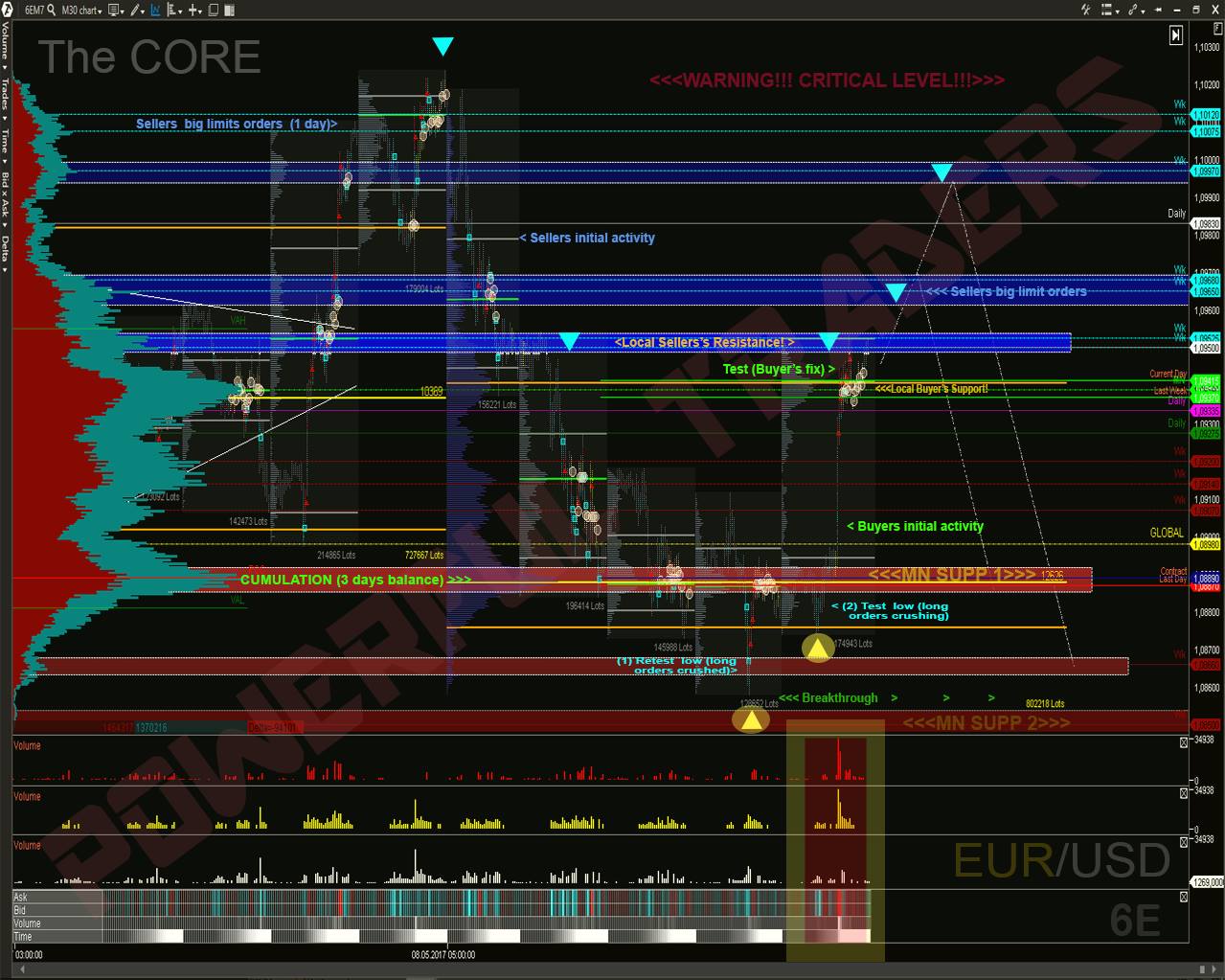

“DOM” (Depth of Market)

- Main base and principles

- Bid and Ask Structure

- The initiating activity of Bid and Ask

- Clusters in the structure of balances and cores

- Estimation of Pending Order Overweight

- Time / Price / Volume – Myths and Reality

- Session dynamics and DOM

FOURTH SECTION: (min 9 – max 10 webinars)

“ORDER FLOW”

- Basics of general order tape – “Spread Tape”

- Bid / ask arithmetic with residual difference

- Setting filters “Smart Tape” taking into account session properties

- Running and setting up the “order book” on the chart

- Indicator “Dom Levels”, setting and determining the aggressor

- Indicator “Order Flow” with filtering

- Tick chart, basics and basis

- Basics of “Level 1” and “Level 2”

- Order Log and “All prices”

SIXTH SECTION: (min 5 – max 7 webinars)

“FOOTPRINT” Part 2

- Imbalance and delta overweight on different timeframes

- Delta properties in a cumulative environment of balances and cores

- Critical delta in trend / correction / reversal balance phase

- Statistics of volumes and deltas in the context of increasing session activity

- Basics of Open Interest

EIGHTH SECTION: (min 2 – max 3 webinars)

CONCLUSION OF THE COURSE

- F.A.Q – Frequently Asked Questions

- Advice, recommendations, secrets

- Dialogue, answers to the questions of the trader / traders

Education time (approximately):

60 webinars / 90 hours / 20 weeks / 5 months

INDIVIDUAL COURSE: