Accelerated course of study,

for working with the functionality of the

“Navigator” algosystem

VIP COURSE OF PROGRAM:

FIRST SECTION: (min 1 – max 2 webinars)

Configuring the “Navigator” algorithmic system

- Introduction to the “Powerful Traders” resource

- Registration, terms of agreement and download

- Installation procedure “Navigator”

- Start trading terminal

- Opening required schedules

- Activation system

- Introduction of menus and functions

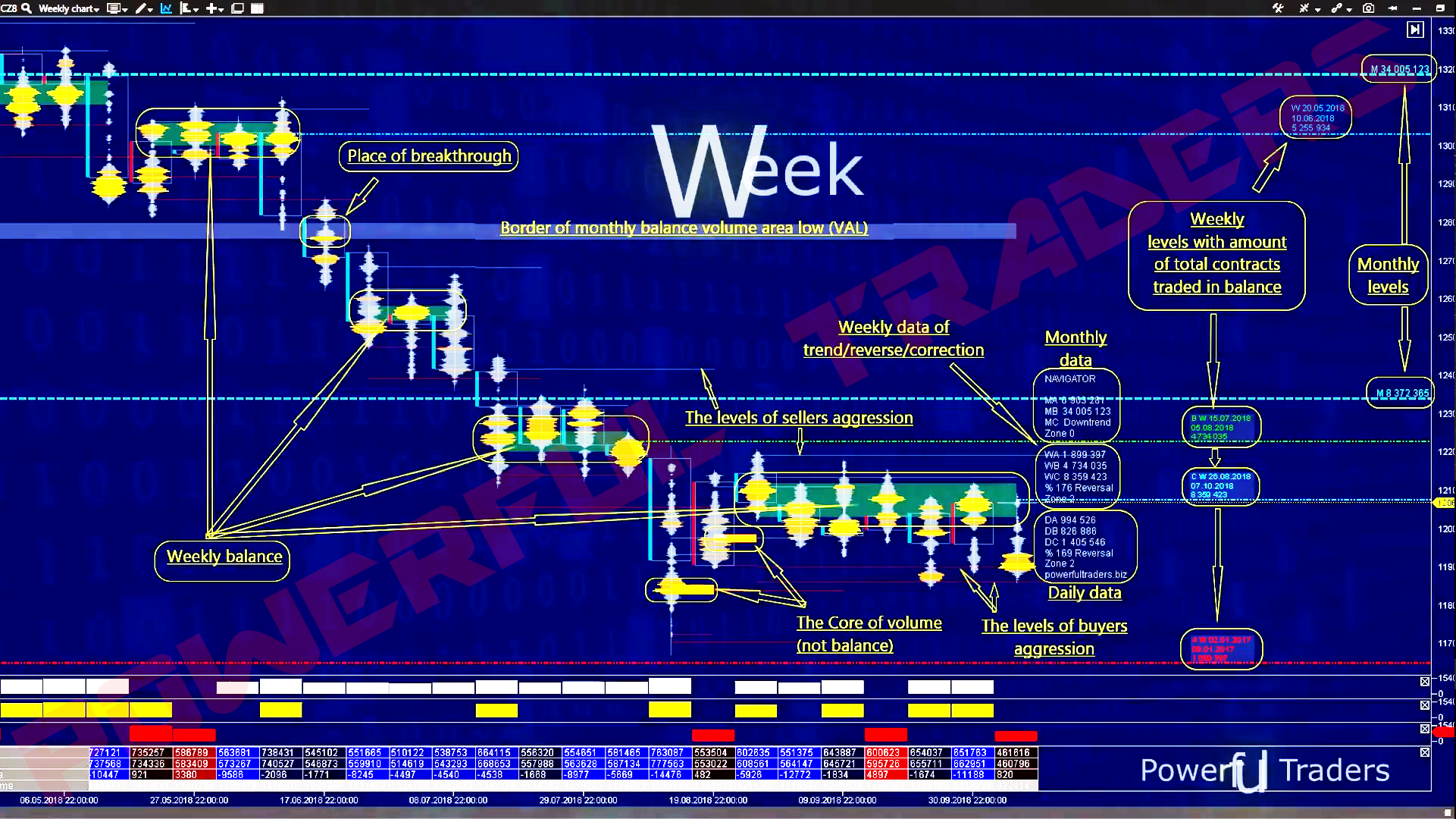

THIRD SECTION: (min 1 – max 2 webinars)

Weekly chart (Week)

- Understanding the details of the weekly schedule template

- “Navigator” – menu and weekly schedule section

- The properties of the distribution of volumes in candles

- Property of balances and liquidity cores

- Integration of volumes in cores and balanced structure

- The boundaries of the aggressor (large limits of the week)

- Acquaintance with the principles of work “glass” and the interaction with the monthly cumulation

- Theory A = B = C phases, reverse and continuation of the trend

- Zone 0 – 7 properties by market profile

- Liquid staples of senior balances and their settings

- Effect and properties of dual levels MN, WK, Daily, H4

- Synchronization of monthly and weekly levels on lower timeframes

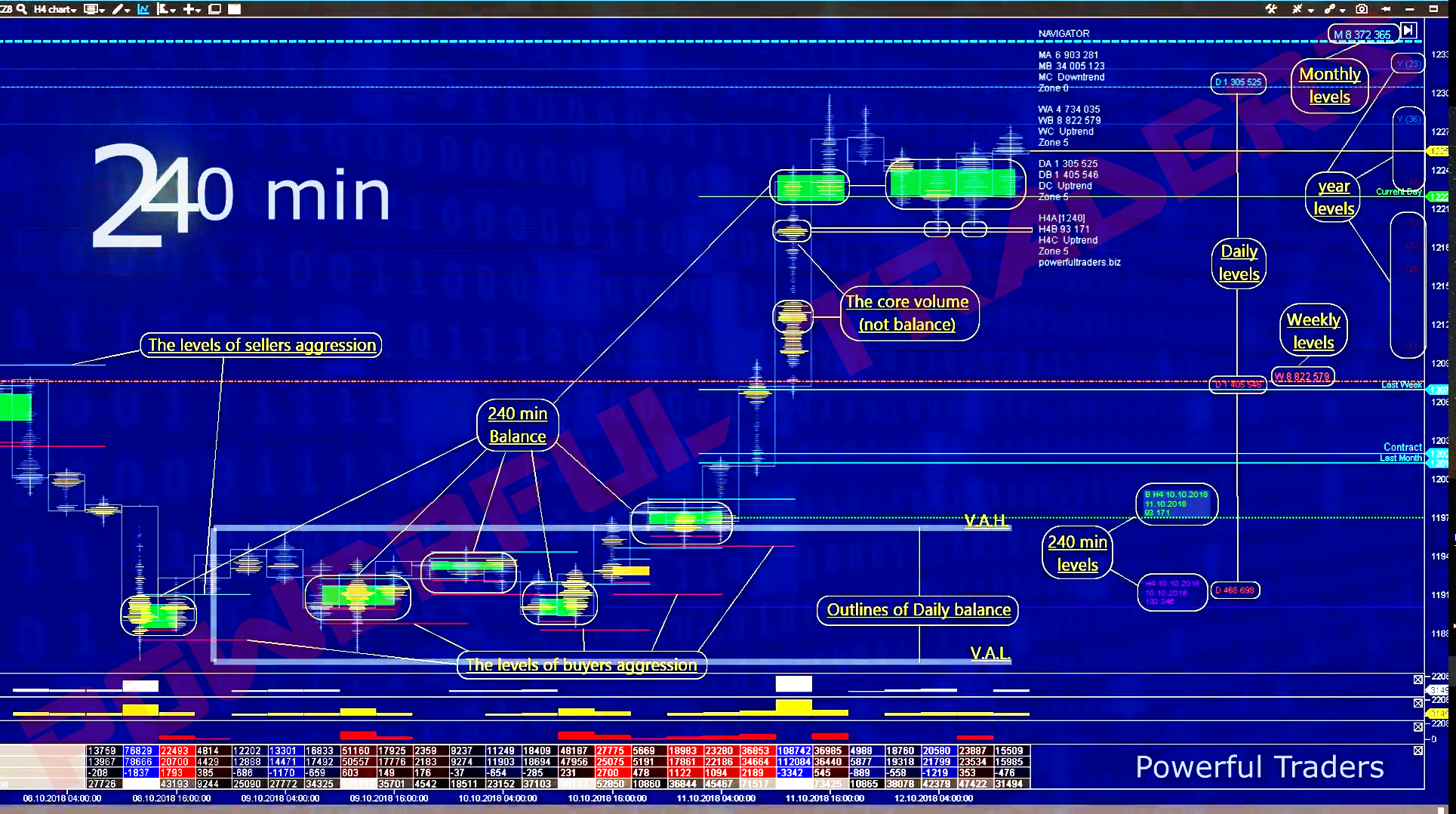

FIFTH SECTION: (min 1 – max 2 webinars)

240 minute chart (H4)

- Calibration of levels of the year and levels of balance sheets of the month, week, day by degree of seniority

- Getting to know the details of the template, 240 minute of graphics

- “Navigator” – menu and section 240 minute chart

- The properties of the distribution of volumes in candles

- Property of balances and liquidity cores

- Integration of volumes in cores and balanced structure

- The boundaries of the aggressor (large limits H4)

- Acquaintance with the principles of work of “glass” and interaction with MN, WK, Daily

- Theory A = B = C phases, reverse and continuation of the trend

- Zone 0-5 properties by market profile

- Liquid staples of senior balances and their settings

- Effect and properties of dual levels MN, WK, Daily, H4

- The effect of gravity liquidity, according to the “Planet satellites”

- Synchronization of monthly, weekly, daily and 240 min. levels on lower timeframes

SEVENTH SECTION: (min 2 – max 3 webinars)

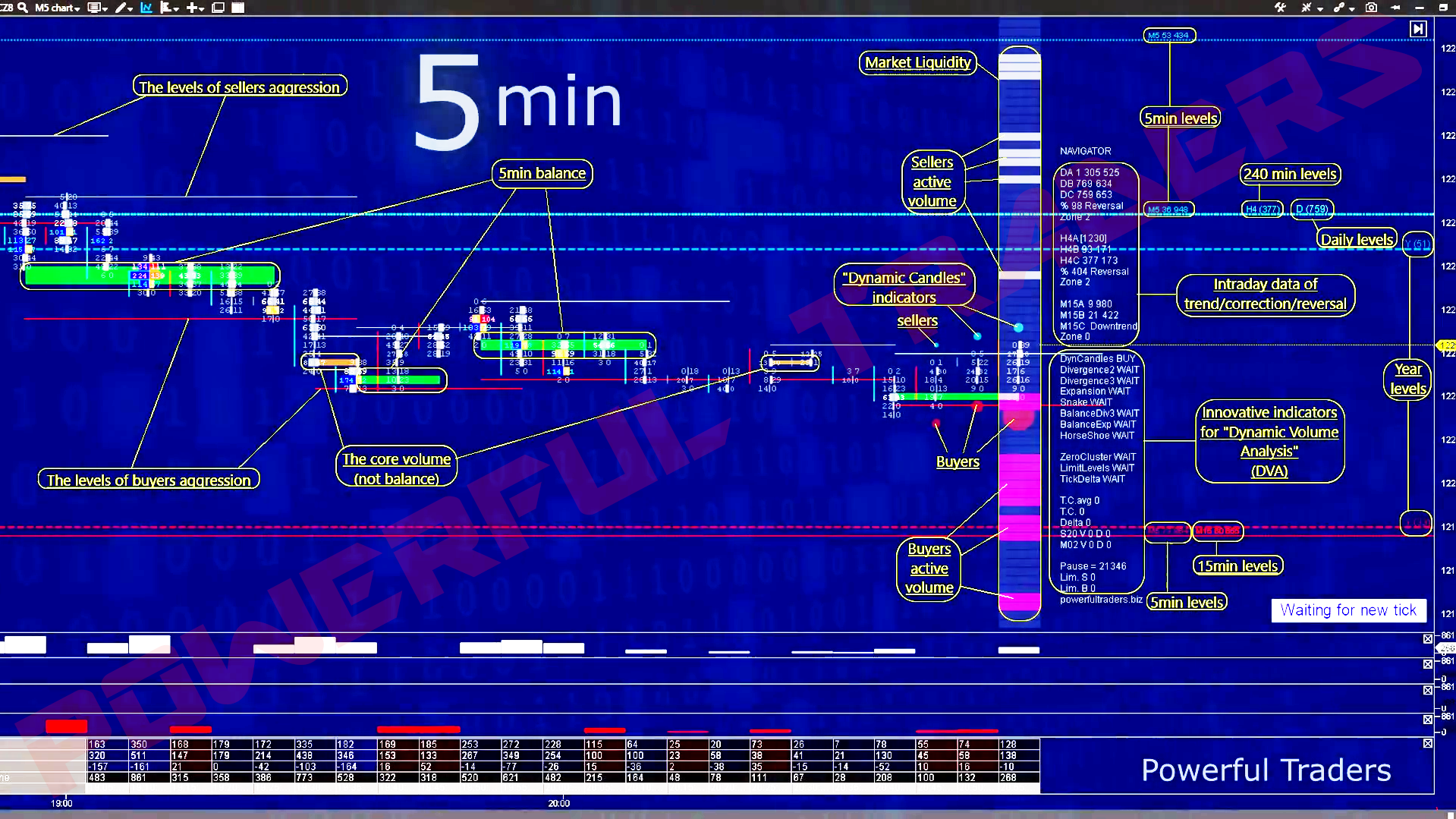

5 minute chart

- Calibration of levels of the year and levels of balance sheets of the month, week, day, 240 min., 15 min. by degree of seniority

- Acquaintance with the details of the template, 5 minute schedule

- “Navigator” – menu and section 5 minute chart

- Imbalances of bid / asuka in 5 minute candles

- The property of clusters in the cumulations of balances and nuclei

- Integration of volumes in cores and balanced structure

- The boundaries of the aggressor (large limit 5 minute charts)

- Acquaintance with the principles of “glass” work and interaction with MN, WK, Daily, H4, 15 min

- The technique of placing stoploss and targeted targets with a view of the short / medium / long term

Education time (approximately):

25 webinars / 38 hours / 9 weeks / 2 or 2,5 months

INDIVIDUAL COURSE:

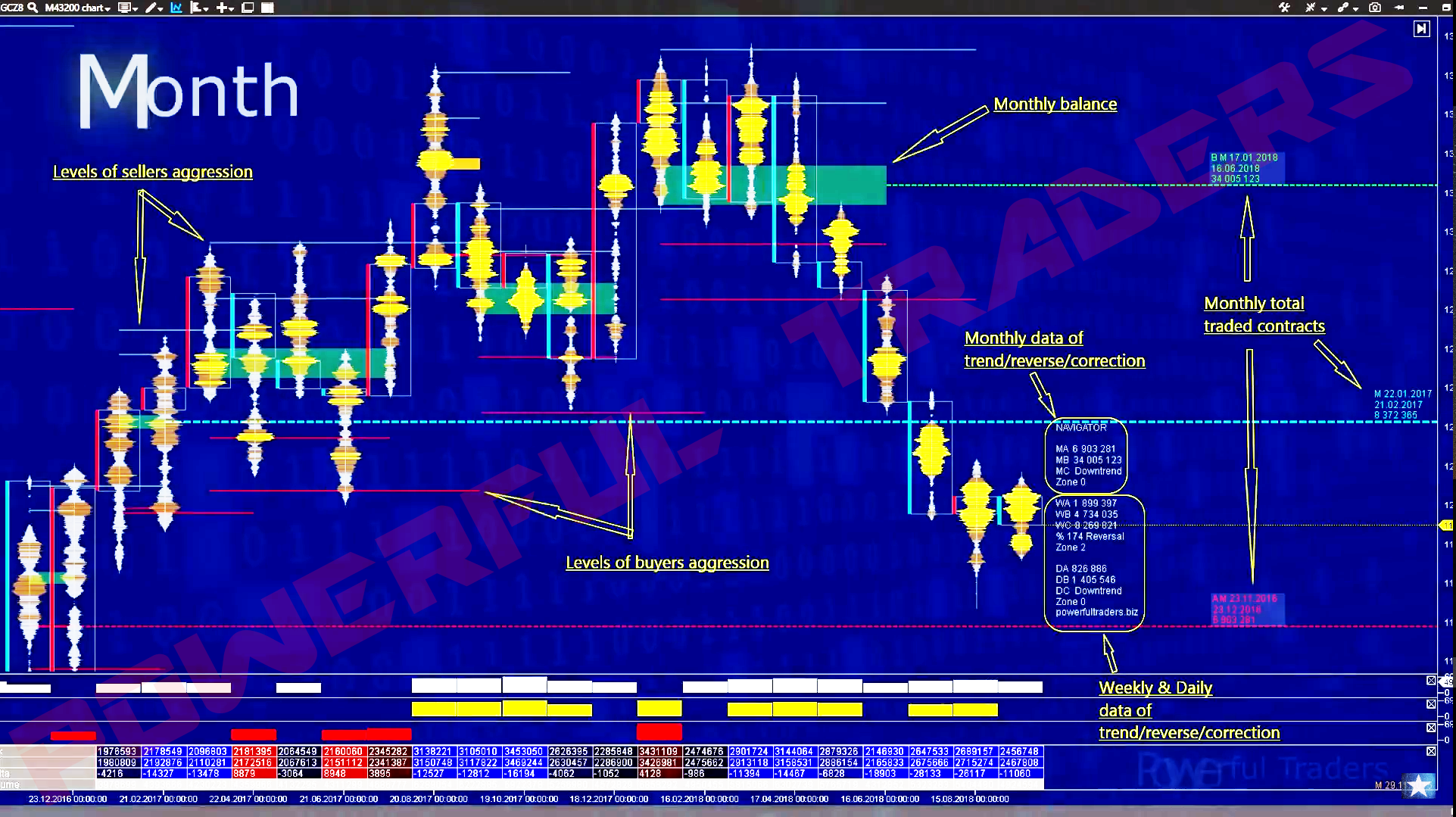

SECOND SECTION: (min 1 – max 2 webinars)

Monthly chart (Month)

- Understand the details of the monthly chart template

- “Navigator” – menu and section of the monthly schedule

- The properties of the distribution of volumes in candles

- Property of balances and liquidity cores

- Integration of volumes in cores and balanced structure

- The boundaries of the aggressor (large limit)

- Introduction to the principles of the PT’s DOM

- Theory A = B = C phases, reverse and continuation of the trend

- Zone 0 – 7 properties by market profile

- Synchronization of monthly levels for lower timeframes

FOURTH SECTION: (min 1 – max 2 webinars)

Daily chart (Daily)

- Calibration of the levels of the month and week according to the degree of seniority

- Acquaintance with the point volumes of the global histogram of the year

- Acquaintance with the details of the template, daily schedule

- “Navigator” – menu and daily chart section

- The properties of the distribution of volumes in candles

- Property of balances and liquidity cores

- Integration of volumes in cores and balanced structure

- The boundaries of the aggressor (large limits of the week)

- Acquaintance with the principles of work “glass” and interaction with MN

- Theory A = B = C phases, reverse and continuation of the trend

- Zone 0 – 5 properties by market profile

- Effect and properties of dual levels MN, WK, Daily

- Liquid “staples” of senior balances and their settings

- Synchronization of monthly, weekly, daily levels on lower timeframes

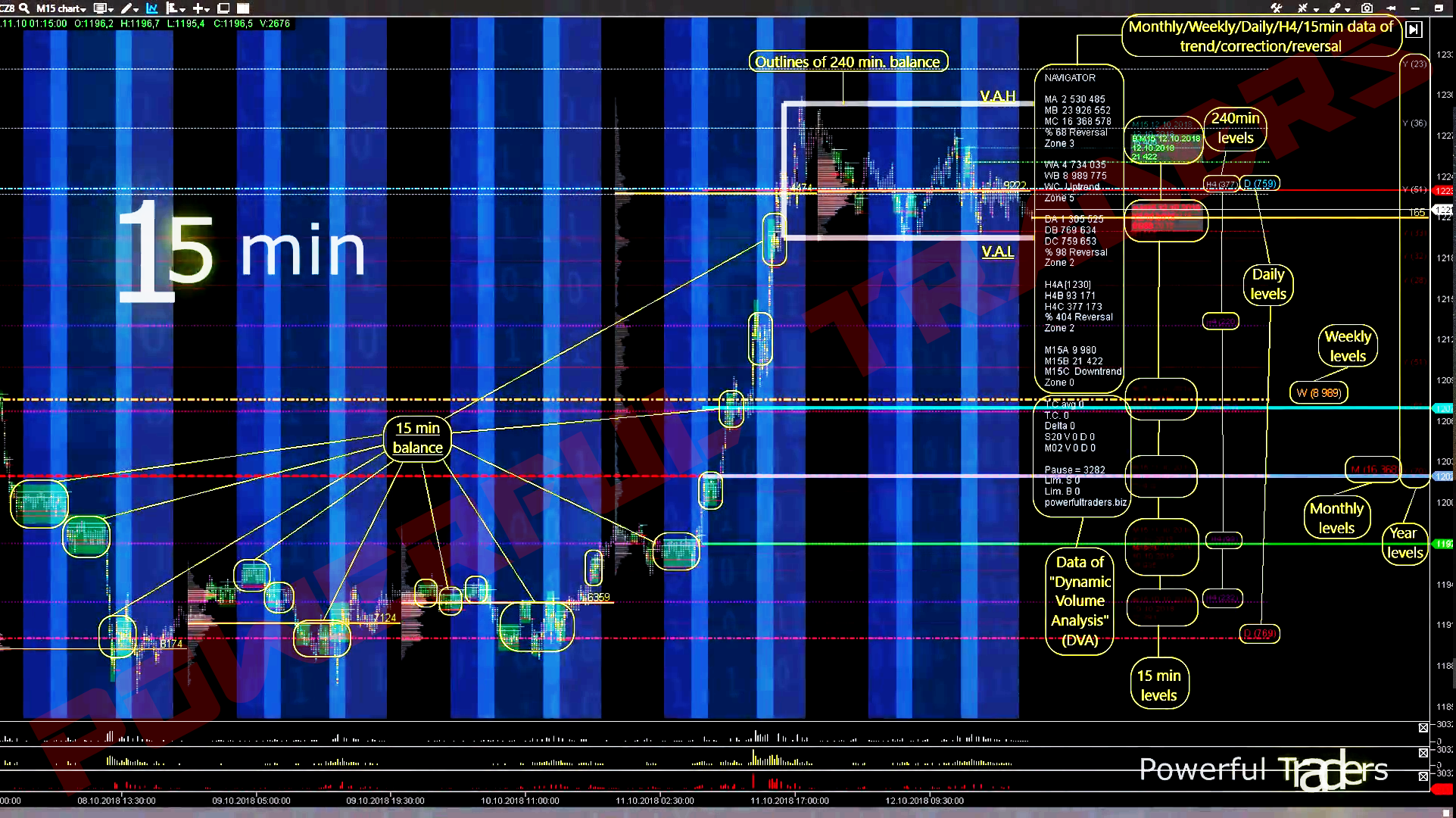

SIXTH SECTION: (min 2 – max 3 webinars)

15 minute chart

- Calibration of levels of the year and levels of balance sheets of the month, week, day, 240 minutes by degree of seniority

- Acquaintance with the details of the template, 15 minute schedule

- “Navigator” – menu and section 15 minute chart

- Heat gradient day card 15 minute candles

- The principle of choosing a 15 minute auction

- Property of balances and liquidity cores

- Integration of volumes in cores and balanced structure

- The boundaries of the aggressor (large limits H4)

- Acquaintance with the principles of work of “glass” and interaction with MN, WK, Daily, H4

- Theory A = B = C phases, reverse and continuation of the trend

- Zone 0-5 properties by market profile

- Effect and properties of dual levels MN, WK, Daily, H4, 15 min

- The effect of gravity liquidity, according to the “Planet satellites”

- Liquid staples of senior balances and their settings

- Sessional interaction of Asia, Europe and America

- Synchronization of monthly, weekly, daily and 240 min. and 15 min. levels on lower timeframes

EIGHTH SECTION: (min 3 – max 5 webinars)

High-Pecision Market Entry (HPME)

- Theory A = B = C phases, reverse and continuation of the trend

- Zone 0-5 properties by market profile

- Effect and properties of dual levels MN, WK, Daily, H4, 15 min, 5 min

- The effect of gravity liquidity, according to the “Planet satellites”

- Acquaintance with the market liquidity scale “Market Liquidity”

- Introducing the revolutionary Dynamic Analysis indicators: “Dynamic Candles”, “Divergence2”, “Divergence3”, “Expansion”, “Snake”, “Balance Div3”, “Balance Expansion”, “Horse Shoe”, “Zero Cluster”, “Limit Levels “,” Pause “,” Limit orders “

- Synchronization of monthly, weekly, daily and 240 min., 15 min. and 5 min. levels

- Instructions for the implementation of high-precision trading on the basis of “TickDelta”, “Snake”